Struggling with slow hiring cycles, regulatory burden, and poor culture matches in financial services recruitment? Discover how CloudApper AI Recruiter integrates seamlessly with your ATS (UKG, Workday, iCIMS, Greenhouse, Lever, Oracle HCM) to accelerate hiring, enforce compliance, and ensure candidate and culture fit—all without disrupting your current systems.

As a recruitment professional with extensive experience using platforms like UKG, iCIMS, Workday, Greenhouse, Lever, and Oracle HCM, I’ve witnessed how financial firms battle against drawn-out hiring processes, regulatory scrutiny, and high turnover. Major banks such as JPMorgan, Goldman Sachs, and Citigroup now invest heavily in AI to streamline operations and sharpen their competitive edge. Despite this momentum, many TA teams still struggle to balance compliance, cultural fit, and efficiency. That’s where CloudApper AI Recruiter makes a dramatic difference.

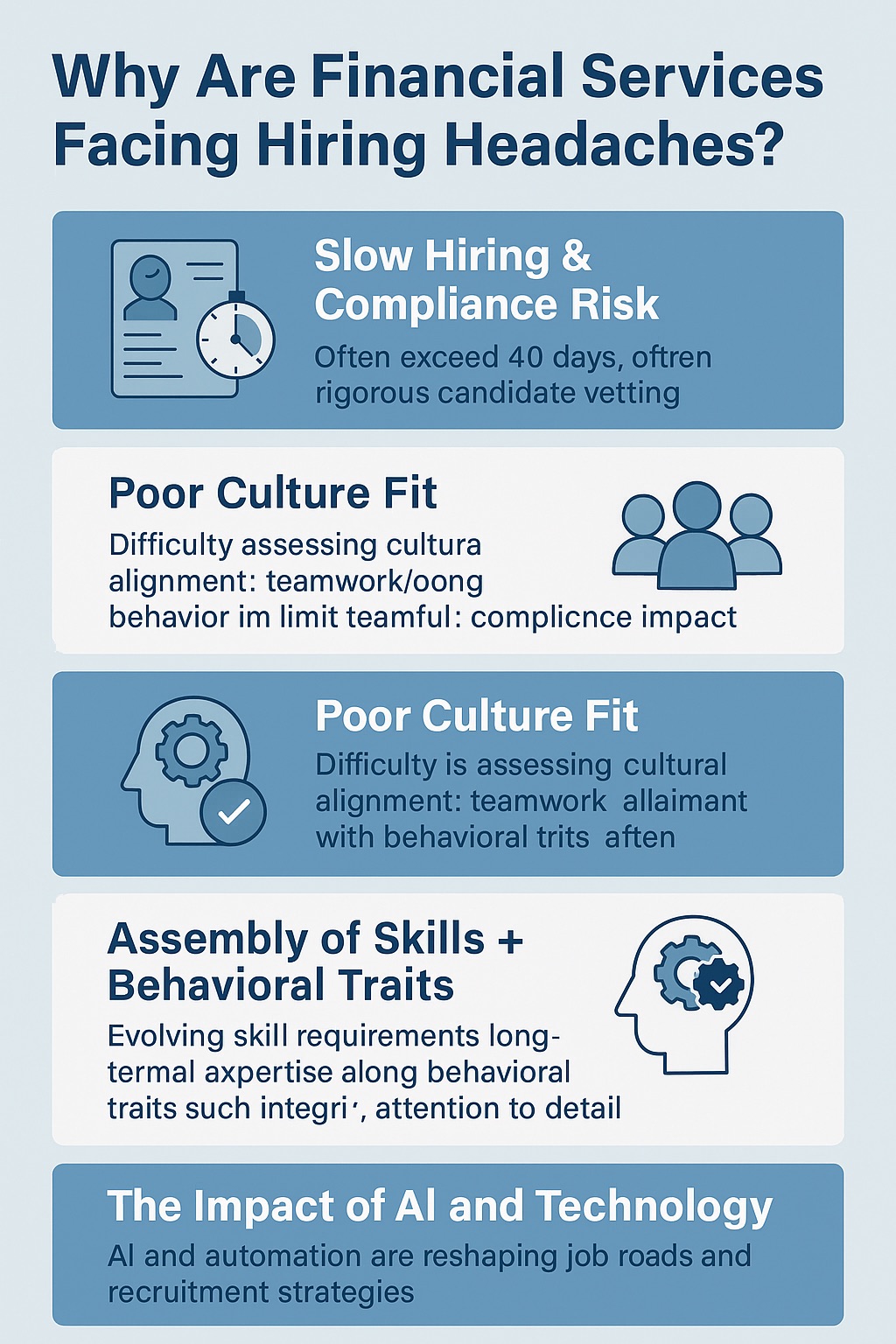

Why Are Financial Services Facing Hiring Headaches?

The financial services sector is experiencing significant challenges in hiring top talent. These issues stem from a mix of regulatory demands, evolving skill requirements, and the need for cultural alignment. Below is a detailed breakdown of the primary factors contributing to these hiring headaches.

1. Slow Hiring & Compliance Risk

-

Lengthy Hiring Cycles:

The average hiring process in financial services often exceeds 40 days, significantly longer than in many other industries. This is due in part to the sector’s reliance on traditional recruitment methods, which involve multiple interview rounds, background checks, and reference verifications. -

Rigorous Compliance Checks:

Financial institutions are subject to strict regulations, including anti-money laundering (AML), know-your-customer (KYC), and other legal requirements. Each candidate must undergo extensive vetting, including criminal background checks, credit history reviews, and sometimes even regulatory approval. These steps are essential to mitigate risk but add considerable time to the process. -

Business Impact:

The extended time-to-hire can leave critical roles unfilled, undermining a firm’s ability to stay competitive and responsive to market changes. Delays can also result in lost revenue opportunities and increased workloads for existing staff, impacting morale and productivity.

2. Poor Culture Fit

-

Importance of Cultural Alignment:

Research indicates that hiring employees who fit well with the organizational culture leads to 90% higher job satisfaction and 84% better performance. In financial services, where teamwork, trust, and ethical behavior are paramount, culture fit is especially crucial. -

Challenges in Assessment:

Despite its importance, accurately evaluating culture fit remains difficult. Traditional interviews often fail to uncover core values, attitudes, and work styles. Financial firms may also struggle to articulate and measure their unique culture, making it harder to screen for alignment. -

Consequences of Poor Fit:

Mismatches can result in higher turnover, lower engagement, and increased compliance risk if employees do not adhere to the firm’s ethical standards.

3. Assembly of Skills + Behavioral Traits

-

Evolving Skill Requirements:

The rise of digital banking, fintech, and artificial intelligence (AI) is transforming the skills needed in financial services. Banks now seek candidates with technical expertise in data analytics, cybersecurity, and automation, alongside traditional financial acumen. -

Demand for Integrity and Regulatory Sensitivity:

Beyond technical skills, financial institutions prioritize behavioral traits such as integrity, attention to detail, and regulatory awareness. These soft skills are critical for maintaining compliance and protecting the organization’s reputation. -

Assessment Complexity:

Evaluating both hard and soft skills requires a multifaceted approach, including behavioral interviews, psychometric testing, and scenario-based assessments. Many firms lack the tools or processes to do this effectively at scale.

4. The Impact of AI and Technology

-

Changing Role Profiles:

AI and automation are reshaping job descriptions, requiring employees to adapt quickly to new technologies and workflows. This increases the need for continuous learning and agility, further complicating the hiring process. -

Recruitment Process Evolution:

As roles become more complex, recruitment strategies must evolve to assess both technical proficiency and adaptability. Firms are increasingly turning to AI-driven assessment tools, but adoption is uneven across the industry.

How Can AI Improve Financial Talent Hiring?

1. Integrating Compliance and Documentation

CloudApper AI Recruiter ensures transparency, audit tracking, and EEO compliance. Every application, AI-interview, and feedback loop is logged and fully traceable—crucial in an industry where data protection and regulatory standards are paramount.

2. Accelerating Time-to-Hire

Analytics from Deloitte and Asendia report AI-reduced time-to-hire by ~18–62%. In finance, that means filling roles like compliance analysts or financial advisors faster—while staying on top of changing regulations.

3. Enhancing Culture & Behavioral Fit

Finance firms report that poor culture fit costs about $14,900 per bad hire. CloudApper uses objective AI-driven questionnaires and scenario-based assessments to assess candidate alignment with your values and compliance mindset.

4. Improving Candidate Experience

Where the runner-ups experience fall-offs rates over 50%, CloudApper’s AI chat tools reduce drop-off to 15% or less through conversational engagement and prompt follow-up. This aligns with reported 3× higher completion rates for AI-enabled interactions.

Traditional Hiring vs AI-Driven Efficiency: Why Financial Services Are Making the Switch

In the fast-paced and compliance-heavy world of financial services, traditional hiring processes are no longer sustainable. Lengthy time-to-hire, overwhelming manual tasks, and unreliable culture fit assessments not only delay operations but also introduce compliance risks and increase turnover. That’s where AI recruitment technology steps in. This side-by-side comparison reveals how CloudApper AI Recruiter dramatically outperforms outdated methods—accelerating hiring, ensuring regulatory adherence, and improving the quality of hires—all while integrating seamlessly with your existing ATS platforms.

Comparison Table: CloudApper AI Recruiter vs Traditional Hiring in Financial Services

| Feature | Traditional Hiring | With CloudApper AI Recruiter |

|---|---|---|

| Time to Hire | Typically 40+ days due to manual screening, multiple interview rounds, and compliance delays. | Reduced to ~21 days through automated screening, 24/7 AI availability, and instant scheduling. |

| Manual Tasks | High recruiter workload—includes resume sifting, interview coordination, follow-ups, and documentation. | ~67% fewer manual tasks through automation of resume filtering, candidate communication, and scheduling. |

| Compliance Support | Reactive processes—compliance is verified manually, often at later stages, increasing audit risk. | Built-in audit trails, consent logging, and real-time documentation to support KYC/AML protocols. |

| Cultural Fit Assessment | Relies on subjective judgment and unstructured interviews, often missing critical soft skills. | Uses AI-led behavioral and scenario-based assessments to ensure alignment with company values. |

| ATS Integration | Manual data entry, disconnected tools, and limited reporting—risk of lost or duplicated data. | Seamless plug-and-play integration with ATS platforms like UKG, Workday, Lever, Greenhouse, and iCIMS. |

| Candidate Engagement | Inconsistent communication, leading to high drop-off rates and a poor candidate experience. | Conversational AI ensures constant engagement, reducing drop-offs by up to 70%. |

| Cost per Hire | Often exceeds $4,000 per hire due to inefficiencies and extended timelines. | Reduced to ~$2,500 by eliminating delays and lowering recruiter workload. |

| Turnover Risk | Higher risk due to poor fit, rushed decisions, or overlooked red flags. | AI assessments highlight potential red flags early and improve long-term employee retention. |

What Top Questions Should Recruiters Ask?

Can AI cut hiring time for compliance-heavy roles?

Yes. CloudApper’s AI screens and prompts candidates 24/7, cutting sourcing, filtering, and scheduling delays—saving up to 50% in time to hire.

Can AI help find the right culture fit ethically?

Yes. Structured assessments and blind screening highlight behavioral alignment, not just technical credentials—reducing bias and aligning diversity with culture.

Will AI track compliance documentation?

Absolutely. Every interaction, consent, interview, and accommodation request is logged for complete traceability.

Does it fit with existing ATS systems?

Yes—CloudApper integrates seamlessly with major HR and ATS platforms—no data duplication or disruption.

Real Impact Snapshot

| Metric | Traditional Process | With CloudApper AI Recruiter |

|---|---|---|

| Time to Hire | ~42 days | ~21 days |

| Cost per Hire | ~$4,100 | ~$2,500 |

| Candidate Drop-Off Rate | ~50% | ~15% |

| Time Saved in Manual Tasks | — | ~67% |

Further analysis shows AI-treated hires have a 30% lower turnover and 85% higher interview-to-hire success. In financial services, these improvements compound into stronger performance and reduced compliance headaches.

My Field-Tested Best Practices

I’ve successfully led implementations at regional banks and mid-sized fintechs. Here’s what worked:

-

Pilot with One Role – Usually compliance operations or auditor roles. Track bias, quality, and regulatory alignment.

-

Use Data to Optimize – Weekly bias reports and candidate feedback quickly uncovered mismatches or friction points.

-

Involve TA and Compliance Teams – Alignment ensures the AI process is seen as augmentation—not replacement.

-

Formalize AI Policy – Clear language about AI use, data privacy, culture-fit evaluation, and candidate experience.

Beyond Hiring: Workflow Automation & Retention

-

Automated Interview Scheduling – AI chatbot handles availability and reminders, synced with ATS calendars.

-

Onboarding Preparation – Bot collects forms, verifies credentials, and initiates background checks—all before Day 1.

-

Retention Alerts – Early-warning analytics flag candidates showing job dissatisfaction during probation—allowing early intervention.

FAQ

Q: Is AI reliable in regulated hiring environments?

Yes—CloudApper ensures transparency, auditability, and consent tracking to support both compliance and candidate fairness.

Q: What about data privacy?

All data is encrypted, sourced ethically, and kept GDPR/CCPA compliant. Candidate disclosures are built in.

Q: Does AI bypass human screening?

No. Recruiters retain final decision authority. AI handles routine tasks and enhances decision quality through structured screening.

Q: What roles work best with AI?

High-volume roles like financial analysts, auditors, customer service reps—and compliance-heavy positions—benefit most.

Q: How hard is integration?

Minimal. CloudApper offers plug-and-play connectors for UKG, Workday, iCIMS, Greenhouse, Lever, Oracle HCM, plus customizable API support.

Financial services recruitment demands a delicate balance of speed, compliance, and cultural alignment. CloudApper AI Recruiter delivers that balance—automating repetitive tasks, enforcing regulatory controls, elevating candidate experience, and maintaining cultural excellence. Let AI do the heavy lifting—while your team focuses on building a future-ready workforce.

Ready for a demo or pilot plan in your finance team? Reach out to explore next steps.