Managing contractors, consultants, freelancers, and statement of work (SOW) engagements is becoming increasingly complex for growing organizations. When you’re paying premium rates for external talent while also managing full-time employees, understanding how to track spending, ensure compliance, and coordinate responsibilities across departments becomes critical.

For small to mid-size companies, especially in industries like financial services, technology, and professional services, the external workforce often represents a significant—and growing—portion of total labor spend. Yet many organizations struggle with basic questions: Who should manage these workers? How do we track their costs compared to employees? Where should this responsibility sit—in HR, Finance, or Procurement?

Let’s explore practical solutions for managing your external workforce effectively, even when your internal resources are limited.

Understanding the External Workforce Landscape

The external workforce includes several categories of workers, each with different management needs:

Independent Contractors: Individuals who work for your organization on a project or hourly basis but aren’t employees. This includes highly skilled consultants, software developers, designers, and specialized professionals.

Contingent Workers: Temporary staff provided through staffing agencies. These workers might be on your premises but remain employees of the agency.

Freelancers: Self-employed individuals who typically work remotely and may serve multiple clients simultaneously.

Statement of Work (SOW) Engagements: Companies or consultancies hired to deliver specific projects or services, often with defined deliverables and timelines.

Each category requires different approaches to onboarding, payment, compliance management, and performance tracking. Understanding these differences helps you build appropriate management systems.

Why External Workforce Management Is Challenging

Organizations struggle with external workforce management for several interconnected reasons:

Lack of Visibility

Only 35% of organizations feel they have sufficient visibility into contingent workforce activities, despite 75% of Chief Procurement Officers considering it a top priority. When different departments hire contractors independently, no one has a complete picture of total external workforce spend or how many contractors are currently working.

Unclear Ownership

The question of who should manage external workers sits at an uncomfortable intersection between HR, Procurement, and Finance. HR traditionally handles people management but may lack experience with vendor contracts and cost negotiation. Procurement excels at supplier management and cost control but isn’t equipped for workforce engagement and performance management. Finance tracks the spending but doesn’t necessarily manage the relationships or work quality.

Compliance Risks

Worker misclassification, tax reporting errors, and labor law violations create significant legal and financial risks. Each jurisdiction has different rules about when someone should be classified as an employee versus a contractor, and getting this wrong can result in substantial penalties, back taxes, and legal fees.

IT Access and Security Concerns

External workers often need access to systems, data, and facilities, creating security risks. Without proper processes, you might have contractors with system access long after their projects end, or inadequate controls over what data they can see.

Cost Tracking Complexity

Comparing external workforce costs to employee costs isn’t straightforward. Contractor hourly rates might seem high, but they don’t include benefits, payroll taxes, or long-term commitments. Without proper tracking, organizations can’t make informed decisions about when to hire employees versus engaging external talent.

Who Should Manage the External Workforce?

The answer isn’t simple, and it varies by organization. However, research and industry practice suggest that a collaborative model that leverages the strengths of both HR and procurement departments works best.

The Case for HR Ownership

HR leads in aligning contingent worker programs with overall talent strategy and ensuring a holistic workforce approach. HR brings several critical capabilities:

Talent Strategy Alignment: HR can integrate external workers into broader workforce planning, ensuring the right mix of employees and contractors to meet business objectives.

Worker Engagement: HR knows how to onboard workers effectively, manage performance, and create positive work experiences that attract quality talent.

Compliance Expertise: HR understands employment law, worker classification rules, and regulatory requirements that affect how external workers should be engaged.

Performance Management: HR has experience evaluating work quality and ensuring contractors deliver expected results.

However, HR traditionally hasn’t managed large vendor relationships or focused on cost optimization, which is where Procurement adds value.

The Case for Procurement Ownership

Procurement excels in budget control, cost-saving initiatives and financial oversight, ensuring cost-effective workforce solutions. Procurement contributes:

Cost Management: Procurement can negotiate better rates with staffing agencies and vendors, standardize pricing, and eliminate “rogue spend” where departments hire contractors at widely varying rates.

Vendor Management: Procurement knows how to evaluate suppliers, manage contracts, monitor performance, and maintain productive vendor relationships.

Risk Mitigation: Procurement expertise in contractual terms and conditions helps protect the organization from legal and financial risks.

Process Standardization: Procurement can establish consistent workflows for engaging external workers, ensuring every hire follows approved processes.

The limitation is that Procurement may overlook the human elements of workforce management, treating contractors purely as vendors rather than talent.

The Collaborative Solution

The optimal solution lies in a collaborative model with defined responsibilities for each department:

HR Responsibilities:

- Defining workforce strategy and determining when to use external versus internal talent

- Managing worker onboarding and offboarding experiences

- Overseeing performance management and quality of work

- Ensuring compliance with employment laws and worker classification

- Developing engagement strategies for external workers

- Integrating contractors into team cultures and workflows

Procurement Responsibilities:

- Negotiating with staffing agencies and service providers

- Establishing standard rates and contract terms

- Managing vendor relationships and performance

- Controlling costs and eliminating rogue spend

- Ensuring contractual compliance and risk mitigation

- Overseeing payment processes and invoice reconciliation

Finance Responsibilities:

- Tracking total external workforce spending

- Budgeting for contractor and consultant costs

- Comparing external workforce costs to employee costs

- Providing financial reporting and analysis

- Managing the accounts payable process for contractor payments

IT Responsibilities:

- Managing system access provisioning and deprovisioning

- Ensuring security protocols are followed

- Monitoring data access and usage

- Providing technical support as needed

This collaborative approach requires clear communication and defined processes, but it leverages each department’s strengths while covering their blind spots.

Setting Up External Workforce Tracking Systems

For small organizations without elaborate HR systems, tracking external workforce spend and management doesn’t require expensive technology—at least initially. Here’s how to establish visibility:

Start with a Central Registry

Create a master spreadsheet or database that captures all external workers. Include:

- Worker name and type (contractor, consultant, SOW vendor)

- Department and hiring manager

- Project or purpose

- Start and end dates

- Hourly rate or project fee

- Total estimated cost

- Staffing agency or direct engagement

- Contract location (where the actual contract is filed)

- System access granted

- Status (active, completed, extended)

This registry should be maintained by one person or team, with all hiring managers required to report new external worker engagements.

Track Costs Separately

Create separate cost centers or general ledger codes for external workforce spending. Many organizations lump contractor costs into departmental budgets, making it impossible to understand total external workforce spend. By tracking separately, you can:

- Compare total external workforce costs to total employee costs

- Identify which departments use external workers most heavily

- Spot unusually high rates or spending patterns

- Budget more accurately for future needs

- Make data-driven decisions about workforce composition

Establish Approval Workflows

Require formal approval before engaging any external worker. A simple approval workflow might include:

- Hiring manager submits request with justification and budget

- Department head approves business need

- HR or Procurement reviews for compliance and rate reasonableness

- Finance approves budget availability

- Contract is executed and worker is added to central registry

This ensures proper oversight without creating unnecessary bureaucracy.

Monitor Ongoing Activity

Don’t just track the initial engagement—monitor ongoing activity:

- Review contractor timesheets or invoices against original estimates

- Check in on project progress and deliverables

- Verify that contractors are actually providing value

- Identify contracts approaching end dates for renewal decisions

- Track any scope changes or rate increases

Managing Compliance for External Workers

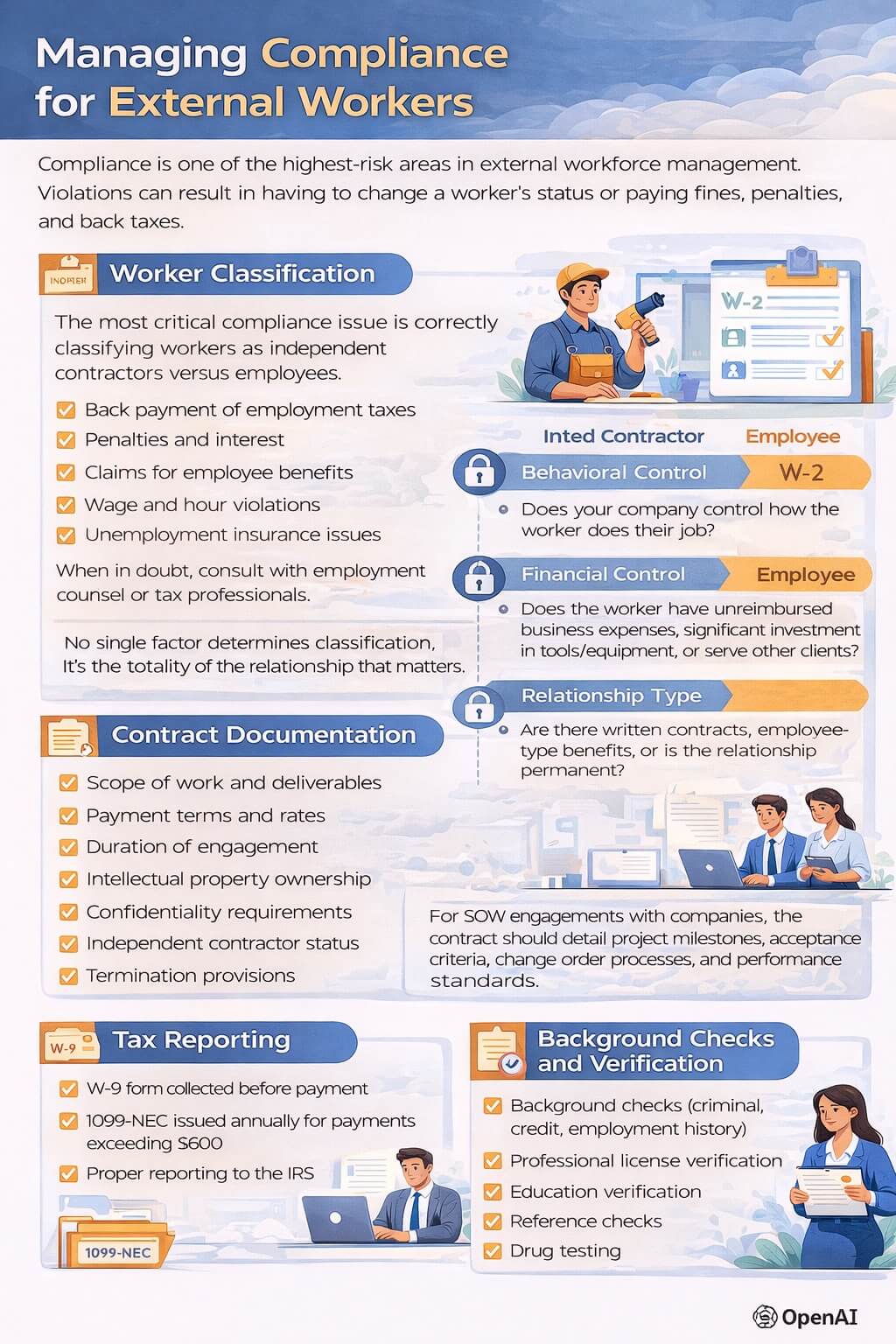

Compliance is one of the highest-risk areas in external workforce management. Violations can result in having to change a worker’s status or paying fines, penalties, and back taxes.

Worker Classification

The most critical compliance issue is correctly classifying workers as independent contractors versus employees. Misclassification exposes you to:

- Back payment of employment taxes

- Penalties and interest

- Claims for employee benefits

- Wage and hour violations

- Unemployment insurance issues

In the United States, the IRS uses a common law test examining the degree of control and independence in the relationship. Key factors include:

- Behavioral control: Does your company control how the worker does their job?

- Financial control: Does the worker have unreimbursed business expenses, significant investment in tools/equipment, or serve other clients?

- Relationship type: Are there written contracts, employee-type benefits, or is the relationship permanent?

No single factor determines classification. It’s the totality of the relationship that matters. When in doubt, consult with employment counsel or tax professionals.

Contract Documentation

Every external worker engagement should have a written agreement that clearly specifies:

- Scope of work and deliverables

- Payment terms and rates

- Duration of engagement

- Intellectual property ownership

- Confidentiality requirements

- Independent contractor status

- Termination provisions

- Liability and indemnification

For SOW engagements with companies, the contract should detail project milestones, acceptance criteria, change order processes, and performance standards.

Tax Reporting

For U.S.-based contractors, you’ll need:

- W-9 form collected before payment

- 1099-NEC issued annually for payments exceeding $600

- Proper reporting to the IRS

For foreign contractors, additional considerations apply regarding tax withholding and reporting.

Background Checks and Verification

Depending on your industry and the work being performed, you may need:

- Background checks (criminal, credit, employment history)

- Professional license verification

- Education verification

- Reference checks

- Drug testing

Document your screening requirements and apply them consistently.

Managing IT Access for External Workers

Security is a major concern when external workers need system access. Establish clear protocols:

Access Provisioning

- Grant minimum necessary access based on job requirements

- Use temporary credentials that expire automatically

- Require multi-factor authentication

- Separate contractor access from employee access where possible

- Document all access granted

Access Monitoring

- Review contractor access permissions regularly

- Monitor for unusual activity or access patterns

- Restrict access to sensitive data and systems

- Use activity logging and audit trails

Access Termination

- Deprovision access immediately upon contract end

- Verify access removal across all systems

- Collect any company equipment or materials

- Confirm return or destruction of confidential data

Many organizations struggle with timely access termination because IT doesn’t know when contractor engagements end. Link your central registry to IT processes so that access expiration dates align with contract end dates.

Comparing External Workforce Costs to Employee Costs

Many organizations only look at the headline rate for contractors and assume they’re expensive. True cost comparison requires examining total cost of workforce:

Employee Total Cost

For employees, calculate:

- Base salary

- Payroll taxes (employer portion of FICA, unemployment taxes)

- Benefits (health insurance, retirement contributions, paid time off)

- Workspace and equipment

- Management and administrative overhead

- Training and development

- Long-term obligations (severance, unemployment claims)

Total employee cost often runs 1.25x to 1.4x base salary when you include all factors.

Contractor Total Cost

For contractors, consider:

- Hourly or project rate

- Agency markup (if using staffing agency)

- Management time for oversight

- Onboarding and training effort

- Any provided equipment or tools

- Contract administration costs

Making the Comparison

To compare fairly, calculate the hourly cost for both:

- Employee hourly cost = Total annual cost / 2,080 hours (or actual hours worked)

- Contractor hourly cost = Rate paid

This comparison helps determine when contractors make financial sense. Generally, contractors are cost-effective for:

- Short-term needs (less than 6-12 months)

- Specialized skills needed occasionally

- Variable workload that doesn’t justify permanent headcount

- Pilot projects or temporary initiatives

For long-term, ongoing needs, employees are usually more cost-effective despite their higher total cost, because you’re building institutional knowledge and long-term capability.

Managing Statement of Work (SOW) Engagements

SOW work requires different management than hourly contractors. These are project-based engagements with specific deliverables.

Clear Scope Definition

The biggest challenge with SOW work is scope creep. Prevent it by:

- Defining precise deliverables with acceptance criteria

- Specifying what’s in scope and what’s out of scope

- Establishing a formal change order process

- Documenting assumptions and dependencies

- Setting clear timelines and milestones

Project Management Practices

Treat SOW engagements like any project:

- Assign a project manager or sponsor

- Establish regular status meetings and reporting

- Track progress against milestones

- Manage risks and issues

- Ensure clear communication channels

Deliverable Acceptance

Create a formal process for reviewing and accepting deliverables:

- Define acceptance criteria upfront

- Test or review deliverables against requirements

- Document acceptance or rejection with specific feedback

- Tie payment to accepted deliverables

- Retain documentation of what was delivered

Vendor Performance Evaluation

After each SOW engagement, evaluate the vendor:

- Did they deliver on time and on budget?

- Was the quality acceptable?

- How well did they communicate?

- Would you hire them again?

- What could be improved?

This evaluation feeds into future vendor selection decisions.

Technology Solutions for Small Organizations

While enterprise organizations use sophisticated Vendor Management Systems (VMS), smaller companies can start with simpler approaches:

Spreadsheet-Based Tracking

For organizations with limited external workforce, a well-designed spreadsheet can provide adequate tracking. Include separate tabs for:

- Active contractors (the registry)

- Historical engagements

- Spending by department

- Vendor/agency list with ratings

- Compliance documentation checklist

Project Management Tools

Tools you might already use for project management can help track contractor work:

- Assign contractors to projects

- Track time and deliverables

- Manage communications

- Store contracts and documentation

- Monitor budget versus actual costs

HR Information Systems

Many modern HRIS platforms now include contingent worker tracking capabilities. Check if your current system supports:

- Contractor profiles separate from employees

- Contract term tracking

- Automated reminders for contract renewals

- Integration with payroll/accounts payable

- Reporting on contractor spend

Vendor Management Systems

When your external workforce grows to dozens or hundreds of workers, consider dedicated VMS technology. Implementing a VMS increases the visibility of the contingent workforce for planning, budgeting, and regulatory compliance and typically delivers a 9.2% year-over-year cost savings.

VMS platforms provide:

- Centralized requisition and approval workflows

- Integration with staffing agencies

- Time and expense tracking

- Invoice management and payment processing

- Compliance monitoring and documentation

- Analytics and reporting

- Performance management

Best Practices for External Workforce Management

Based on industry experience and research, follow these practices:

Establish Clear Policies

Document your organization’s policies on:

- When external workers can be engaged versus hiring employees

- Approval requirements and authority levels

- Rate ranges and negotiation guidelines

- Onboarding and offboarding procedures

- Performance expectations and management

- Compliance requirements and verification

Standardize Contracts

Develop template contracts for different engagement types. This ensures:

- Consistent terms across all engagements

- Legal review happens once, not for every contract

- Faster execution without negotiating every detail

- Reduced legal risk from ad hoc contract language

Build Preferred Vendor Relationships

Rather than using dozens of staffing agencies, establish relationships with a few preferred vendors. Benefits include:

- Better rates through volume commitments

- Higher quality candidates from vendors who understand your needs

- Streamlined processes and integration

- Dedicated support and account management

Regular Audits

Conduct periodic audits to ensure:

- All active contractors are properly documented

- Contracts haven’t expired without renewal

- System access aligns with current engagements

- Rates are competitive and reasonable

- Compliance documentation is complete

- Spending is within budget

Training for Hiring Managers

Educate managers who engage external workers on:

- Company policies and procedures

- Compliance requirements and risks

- How to define scope and manage work

- Where to get help with contracts and negotiations

- Performance management best practices

When to Seek Professional Help

Some organizations benefit from outsourcing part or all of their external workforce management:

Managed Service Providers (MSPs)

MSPs take on end-to-end management of your contingent workforce program, including:

- Vendor relationship management

- Worker sourcing and screening

- Contract and rate negotiation

- Compliance monitoring

- Invoice processing

- Performance reporting

This makes sense when you have a large external workforce but limited internal resources to manage it.

Contingent Workforce Consultants

For organizations building or improving their programs, consultants can help:

- Assess current state and identify gaps

- Design optimal operating models

- Select and implement technology

- Establish policies and processes

- Train internal teams

Legal and Tax Advisors

Given the compliance complexity, consult with specialists for:

- Worker classification determinations

- Contract template development and review

- Multi-state and international considerations

- Tax reporting requirements

- Litigation risk assessment

The Future of External Workforce Management

The external workforce continues to grow. The non-employee workforce has grown substantially in recent years, from 20% in 2010 to nearly 49% of the total workforce globally in 2023. Organizations that develop mature external workforce management capabilities now will have significant advantages.

Trends shaping the future include:

- Greater integration of external workers into total workforce planning

- AI-powered matching of contractors to opportunities

- More sophisticated analytics on workforce composition and effectiveness

- Increased focus on external worker experience and engagement

- Growing compliance complexity requiring better systems and processes

Taking Action: Where to Start

If your organization is struggling with external workforce management, start with these steps:

- Gain Visibility: Create that central registry of all current external workers. You can’t manage what you can’t see.

- Define Ownership: Bring HR, Procurement, and Finance together to agree on who does what. Document responsibilities clearly.

- Establish Basic Processes: Create simple approval workflows and documentation requirements. Start with something workable, even if not perfect.

- Track the Spend: Set up separate cost tracking so you know how much you’re spending on external workforce versus employees.

- Address Compliance: Review your worker classifications and contract documentation. Fix any obvious problems.

- Build Incrementally: You don’t need perfect systems immediately. Start with basics and improve over time as your external workforce grows.

The key is to start somewhere rather than letting the complexity paralyze you into inaction. Even basic processes and tracking provide enormous value compared to the ad hoc, unmanaged approach many small organizations use today.