You remember the early days like they were yesterday. You had three employees, a Google Sheet, and a reminder on your phone that said “Pay everyone Friday.” It felt scrappy, proud, and totally under control.

Then one day you looked up and realized you now have 19 people (or 28… or 47), someone just moved to Texas, another person asked if their signing bonus is taxed differently, and you caught yourself triple-checking a payroll deposit at 11:47 p.m. on a Thursday.

Welcome to the moment every founder in the US and Canada eventually reaches. The question is no longer “Can I keep doing this myself?” It’s “Do I hire an accountant… or is payroll software finally good enough to trust with my entire company?”

I’ve watched hundreds of owners wrestle with this exact choice. Here’s the evergreen guide that works whether you’re reading this today or five years from now.

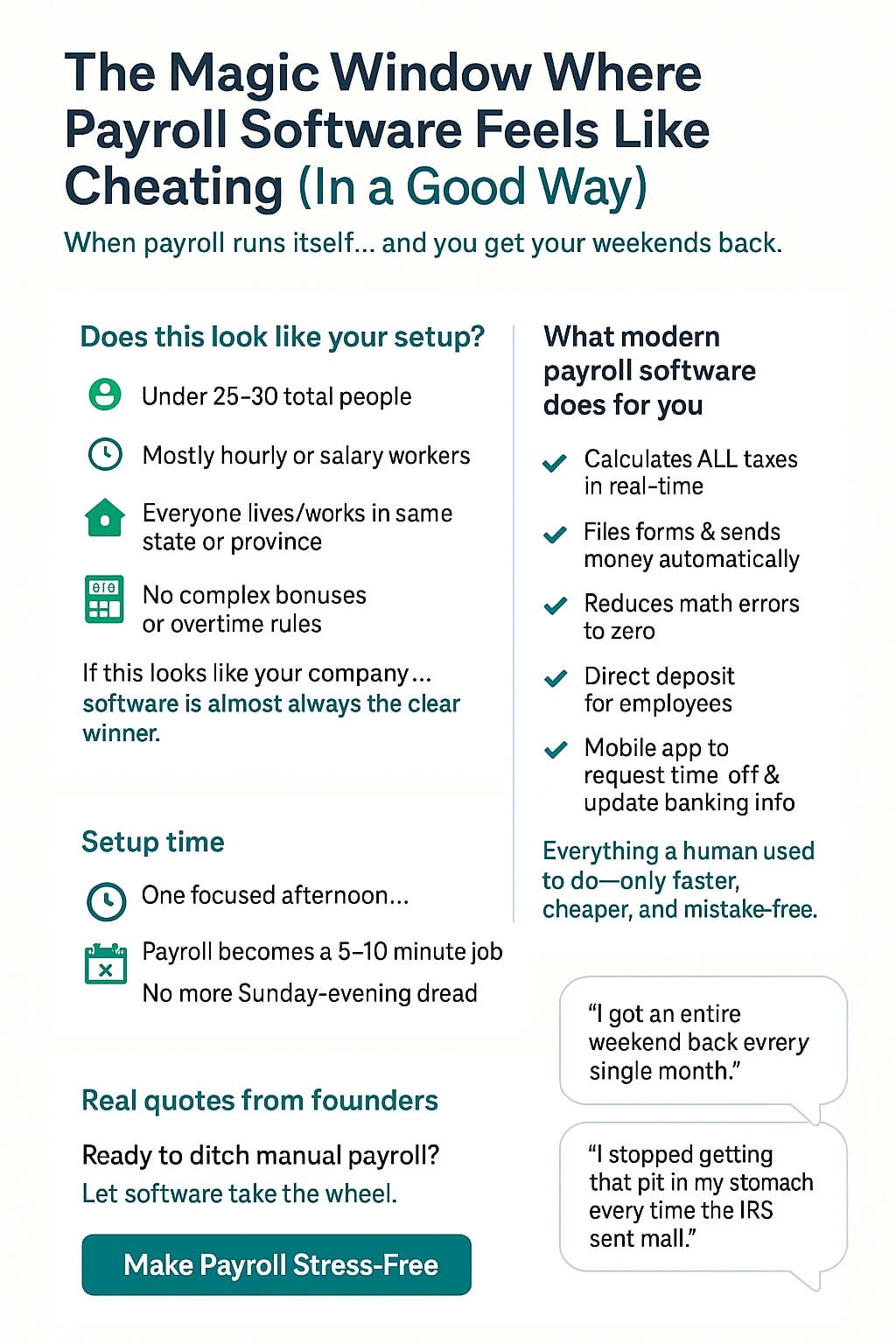

The Magic Window Where Payroll Software Feels Like Cheating (In a Good Way)

If your business still looks like this, software is almost always the clear winner:

- Under 25–30 total people

- Mostly hourly wages or straight salaries

- Everyone lives and works in the same state or province

- No complex bonuses, equity grants, or heavy overtime rules

Modern payroll platforms now do everything a human used to do—only faster, cheaper, and with zero math mistakes. They calculate federal, state, provincial, and local taxes in real time. They file the forms and send the money to the government so you never see another late-penalty notice. Employees get direct deposit and a phone app to see their stubs, request time off, or update their banking info without bugging you.

Setup takes one focused afternoon. After that, running payroll becomes a five-to-ten-minute job instead of a Sunday-evening dread fest.

Founders who make this switch almost always say the same three things:

- “I got an entire weekend back every single month.”

- “I stopped having that pit in my stomach every time the IRS sent mail.”

- “It literally costs less than one employee’s weekly paycheck.”

The Invisible Line Where Software Starts to Feel Risky

Everything changes the moment your business gets even a little complicated. The second you have employees in two different states, or you start paying big commissions, or someone receives stock options, or you’re mixing W-2 employees with 1099 contractors—the rulebook explodes.

One misclassified worker in California can cost you $25,000. One missed quarterly filing in Ontario can trigger daily compounding penalties. One forgotten bonus tax calculation can turn a happy employee into an angry one.

Even the best software can’t replace human judgment when the stakes climb that high. That’s when founders bring in a real accountant—not full-time (almost nobody needs that yet), but part-time, fractional, or quarterly.

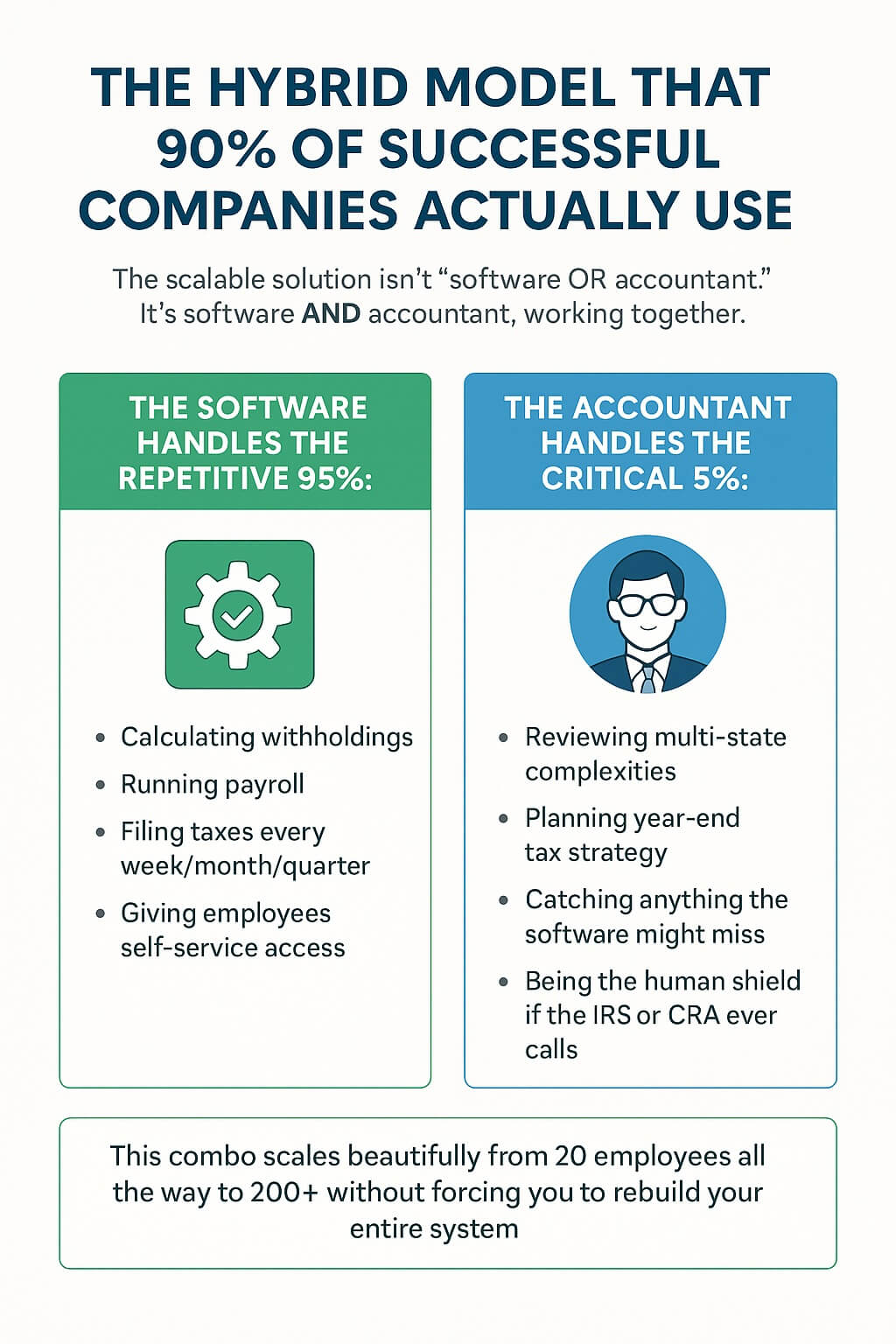

The Hybrid Model That 90% of Successful Companies Actually Use

Here’s the secret nobody puts on a sales page: the winning long-term setup is almost never “software OR accountant.” It’s software AND accountant, working together.

The software handles the repetitive 95%:

- Calculating withholdings

- Running payroll

- Filing taxes every week/month/quarter

- Giving employees self-service access

The accountant handles the critical 5%:

- Reviewing multi-state complexities

- Planning year-end tax strategy

- Catching anything the software might miss

- Being the human shield if the IRS or CRA ever calls

This combo scales beautifully from 20 employees all the way to 200+ without forcing you to rebuild your entire system.

Five Questions That Instantly Tell You Which Path You’re On Right Now

Grab a coffee and answer these honestly:

- Do you have people working in more than one state or province?

- Do you pay commissions, equity, RSUs, or large bonuses?

- Have you ever received a penalty notice or scary letter from the tax agency?

- Are you planning to double your headcount in the next 12–18 months?

- Does the thought of a payroll mistake actually keep you awake at night?

If you answered “yes” to two or more, you’ve already crossed the line. You need both tools. If most answers are “no,” great payroll software alone will feel like the best hire you never made.

The Real Money and Time Breakdown (Numbers That Stay True Year After Year)

Doing payroll manually with spreadsheets Cost: $0 (until the first penalty, then $5k–$50k+) Time: 8–25 hours per month Stress level: High and rising

Good payroll software only Cost: $600–$2,000 per year Time: 20–40 minutes per month Stress level: Almost zero

Software + quarterly accountant review Cost: $2,500–$6,000 per year Time: 1–2 hours per month Stress level: Peaceful sleep

Full-time bookkeeper or in-house accountant Cost: $40,000–$90,000+ per year Only makes sense once you’re well past 75–100 people.

The Questions You’re Probably Googling Right Now (Quick Answers)

“Will payroll software actually file and pay my taxes for me?” Yes. The reputable ones do it automatically and guarantee accuracy.

“Is my data safe in the cloud?” Bank-level encryption. Safer than spreadsheets sitting on your laptop or emailed around.

“Can I run payroll from my phone while traveling?” Two taps and you’re done. Many founders approve payroll from airports or kids’ soccer games.

“What happens if my company outgrows the software?” You export every record in one click and move on. No vendor lock-in nightmares.

“Do I still need an accountant if I have great software?” For day-to-day payroll? Almost never. For tax planning, audits, and peace of mind? Almost always.

The Mindset Shift That Changes Everything

The biggest barrier isn’t money or technology—it’s the story we tell ourselves. “I should be able to handle this myself.” “I don’t want to look like I’m ‘too big’ for my own company.” “If I outsource this, I’m admitting I can’t do it all.”

Let those stories go.

Every founder who eventually makes the switch says the same thing afterward: “I wish I had done this two years earlier.”

Your time compounds. Your peace of mind compounds. Getting payroll off your personal to-do list is one of the highest-ROI decisions you’ll ever make.

Your Next Step (Takes Less Than One Weekend)

If you’re in the “software only” camp:

- Pick two or three top-rated platforms

- Start their free trials (most import your current data in minutes)

- Run one real payroll side-by-side with your old method

- Cancel the old method forever

If you’re in the “software + accountant” camp:

- Get the software running first (it makes the accountant’s life easier and cheaper)

- Ask your network for a referral to a fractional CFO or part-time accountant who loves working with growing companies

- Schedule a quarterly review call and forget about it until the calendar reminder pops up

Either path takes one weekend of focused work and pays you back for years.

Final Thought

You didn’t start a company to become a payroll expert. You started it to build something that matters.

Stop trading your most valuable hours for a task that technology (and the right human backup) can now handle perfectly.

Make the decision today. Your employees deserve to be paid correctly and on time. You deserve to stop carrying the weight alone.