Moving from paper files and spreadsheets to a real human resources information system feels like a huge leap for a small nonprofit. You’re juggling limited budgets, wearing multiple hats, and trying to figure out technology that seems built for companies ten times your size. But staying with manual processes means you’re spending hours on tasks that software could handle in minutes, and you’re probably keeping important employee information in places that aren’t secure or organized.

When your nonprofit has fewer than twenty employees but plans to grow, choosing the right HRIS becomes critical. You need something that works for your current size without being overkill, but also something you won’t immediately outgrow. Let’s walk through how to actually make this decision without getting lost in sales pitches and feature comparisons that all start to sound the same.

What should a small nonprofit actually prioritize in an HRIS?

The temptation when shopping for HRIS systems is to focus on having every possible feature. Vendors will show you impressive demos with capabilities you didn’t even know existed. But for a small nonprofit, the priorities are different than they’d be for a corporation.

Ease of use matters more than you think. When you have sixteen employees and maybe one person handling HR tasks, you can’t afford a system that requires extensive training or technical expertise. If your team finds the system confusing or clunky, they simply won’t use it properly. This leads to incomplete data, workarounds that defeat the purpose, and eventual abandonment of the system.

Cost predictability is crucial for nonprofits operating on tight budgets. Some HRIS platforms have straightforward per-employee-per-month pricing. Others have base fees plus charges for different modules, implementation costs, and surprise fees that pop up later. You need to understand the total cost of ownership over several years, not just the initial quote.

Customer support quality can make or break your experience. Large enterprises have dedicated IT departments to troubleshoot problems. Small nonprofits usually don’t. When something breaks or you need help, you need actual human support that responds quickly and solves problems rather than reading from scripts.

Scalability ensures you won’t need to switch systems in a few years. If you’re planning to grow from sixteen to twenty-five employees and then continue modest growth, your HRIS should handle that expansion without requiring a complete platform change or dramatic price increases that become unaffordable.

Integration capabilities determine whether your new HRIS will actually streamline work or create new headaches. If the system doesn’t talk to your accounting software, benefits providers, or other tools you use, you’ll end up manually transferring data between systems, which wastes time and introduces errors.

How do you evaluate whether all-in-one or best-of-breed makes sense?

This is one of the fundamental decisions in HRIS selection, and it’s especially important for small organizations with limited resources to manage multiple systems.

All-in-one platforms combine payroll, time tracking, benefits administration, document storage, performance management, and applicant tracking in a single system. Everything lives in one place with one login, one vendor relationship, and theoretically seamless data flow between functions. For small teams, this simplicity is incredibly appealing.

The downside is that all-in-one systems are often mediocre at several things rather than excellent at any one thing. The payroll might work fine but the applicant tracking is clunky. The time tracking is decent but the performance management feels like an afterthought. You’re accepting compromises across the board in exchange for convenience.

Best-of-breed means choosing specialized software for each function—one system for payroll, another for time tracking, a different one for applicant tracking. Each tool is typically better at its specific job than the corresponding module in an all-in-one system. However, you now have multiple vendor relationships, multiple bills to pay, and integration challenges where data needs to flow between systems.

For a nonprofit with sixteen employees and limited HR resources, all-in-one usually makes more sense. Managing relationships with four or five different vendors, troubleshooting integration issues, and training staff on multiple platforms simply isn’t realistic. The convenience and simplicity of a single system outweighs the benefits of specialized tools.

The exception might be if you already have software you love for a specific function and it integrates well with HRIS options. If your current time tracking system works perfectly and employees are comfortable with it, you might choose an HRIS that integrates with it rather than forcing everyone to switch.

What questions reveal whether a system will actually work for you?

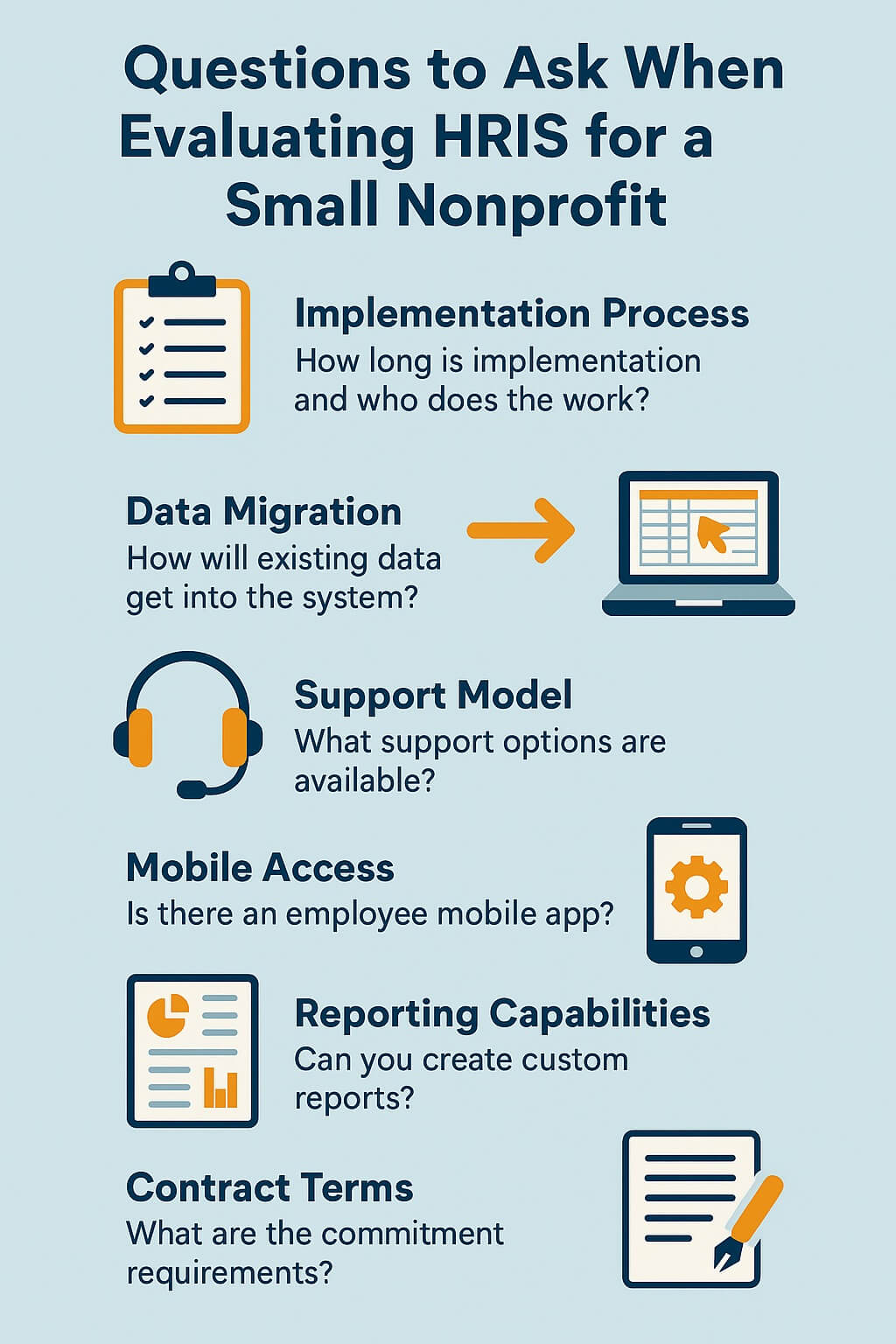

Sales demonstrations are carefully choreographed to show systems at their best. You need to ask specific questions that reveal how the software works in real-world conditions, especially for organizations your size.

Ask about the implementation timeline and process. How long does it typically take from signing the contract to having the system fully operational? What does implementation involve, and who does the work—you or them? Some vendors promise quick implementations but then expect you to do extensive data entry and configuration. Others provide white-glove service but charge separately for it.

Find out about data migration. How will your existing employee information, payroll history, and documents get into the new system? Will the vendor assist with migration or is it entirely on you? What happens if data doesn’t transfer correctly?

Question the support model. When you need help, what happens? Is there phone support, email only, or just a knowledge base? What are the support hours? Do they charge extra for support beyond basic troubleshooting? How quickly do they typically respond to issues?

Ask about mobile access and functionality. Do employees have a mobile app to access pay stubs, request time off, and update information? How does it work? Some mobile apps are just stripped-down versions of the desktop site, while others are genuinely useful.

Inquire about reporting capabilities. What standard reports are available? Can you create custom reports without needing technical skills? For nonprofits, being able to quickly pull reports for grants, board meetings, or audits is essential.

Understand the contract terms. What’s the minimum commitment period? What happens if you need to cancel? Are there penalties? Can you export your data if you leave? Some vendors make it surprisingly difficult to get your own data back if you decide to switch.

How important is nonprofit-specific experience in an HRIS vendor?

This is a nuanced question because nonprofit needs overlap significantly with small business needs, but there are some specific considerations.

Nonprofits often have unique compensation structures including stipends, reimbursements, and various types of contract workers or volunteers. Your HRIS needs to handle these categories without forcing you into workarounds. Some systems are built primarily for traditional employees and struggle with the employment variety common in nonprofits.

Grant reporting requirements mean you might need to track employee time or costs by specific programs or funding sources. If your nonprofit receives government grants or foundation funding, you may need detailed reports showing how personnel costs allocated across different projects. Not all HRIS systems handle this kind of cost allocation easily.

Budget constraints are typically more severe in nonprofits than for-profit companies. Vendors who primarily serve corporate clients may not understand how price-sensitive nonprofits are or offer pricing structures that make sense for smaller organizations.

That said, you don’t necessarily need a vendor who exclusively serves nonprofits. Many excellent HRIS platforms serve small businesses generally and work perfectly well for nonprofits. What matters more is whether the system’s capabilities and pricing align with your specific needs, not whether they use nonprofit terminology in their marketing.

Check whether they offer nonprofit discounts. Many software companies provide reduced pricing for registered 501(c)(3) organizations. Even if it’s not advertised, it’s worth asking. These discounts can make a significant difference in your budget.

What are the hidden costs that surprise small organizations?

The per-employee-per-month price you see advertised is rarely the full story. Understanding total costs prevents budget shocks down the road.

Implementation and setup fees can be substantial. Some vendors charge thousands of dollars for implementation, training, and data migration. Others include basic implementation in their pricing but charge extra for hands-on assistance. Make sure you understand what’s included and what costs extra.

Module pricing means that the base price might only include core HR functions, with payroll, time tracking, benefits administration, and applicant tracking as add-on modules that each cost extra per employee per month. A system advertised at fifteen dollars per employee monthly might actually cost forty dollars once you add the modules you need.

Third-party integration fees occur when connecting your HRIS to benefits providers, 401k administrators, or accounting software. Some integrations are included, others cost monthly fees. These can add up if you need multiple integrations.

Year-end processing sometimes incurs extra charges. Some payroll providers charge additional fees for W-2 processing, year-end tax filing, or generating annual reports. These annual costs should factor into your budget planning.

Training beyond initial onboarding may cost extra. If you need additional training sessions, webinars for new employees, or refresher training, vendors might charge consulting rates.

Premium support tiers mean that basic support is included, but faster response times, dedicated account managers, or phone support require upgrading to a more expensive support tier.

Tax filing and compliance services are sometimes separate from basic payroll. Make sure you understand whether tax deposits, filings, and compliance monitoring are included or cost extra.

Should you involve employees in the selection process?

Getting input from the people who will actually use the system improves both the decision and the eventual adoption.

Department managers who will use the system for time tracking, approvals, and accessing employee information should test the platforms you’re seriously considering. Their perspective on usability and workflow will be different from yours as the administrator.

Employees who will use self-service features should give feedback on the employee experience. Can they easily find pay stubs, update direct deposit information, request time off, and access tax documents? If the employee-facing side is confusing, you’ll spend time answering questions that the system should handle.

However, you don’t need to survey all sixteen employees about every feature. Too many opinions can make the decision impossible. A practical approach is having two or three key stakeholders test finalist systems and provide structured feedback on specific aspects.

Consider setting up brief demonstrations focused on the employee experience rather than just the administrator view. Most vendor demos focus on backend management, but seeing how employees would interact with the system reveals different strengths and weaknesses.

How do you handle the transition from your current systems?

Implementation can be the most stressful part of adopting new HRIS software, but planning ahead makes it manageable.

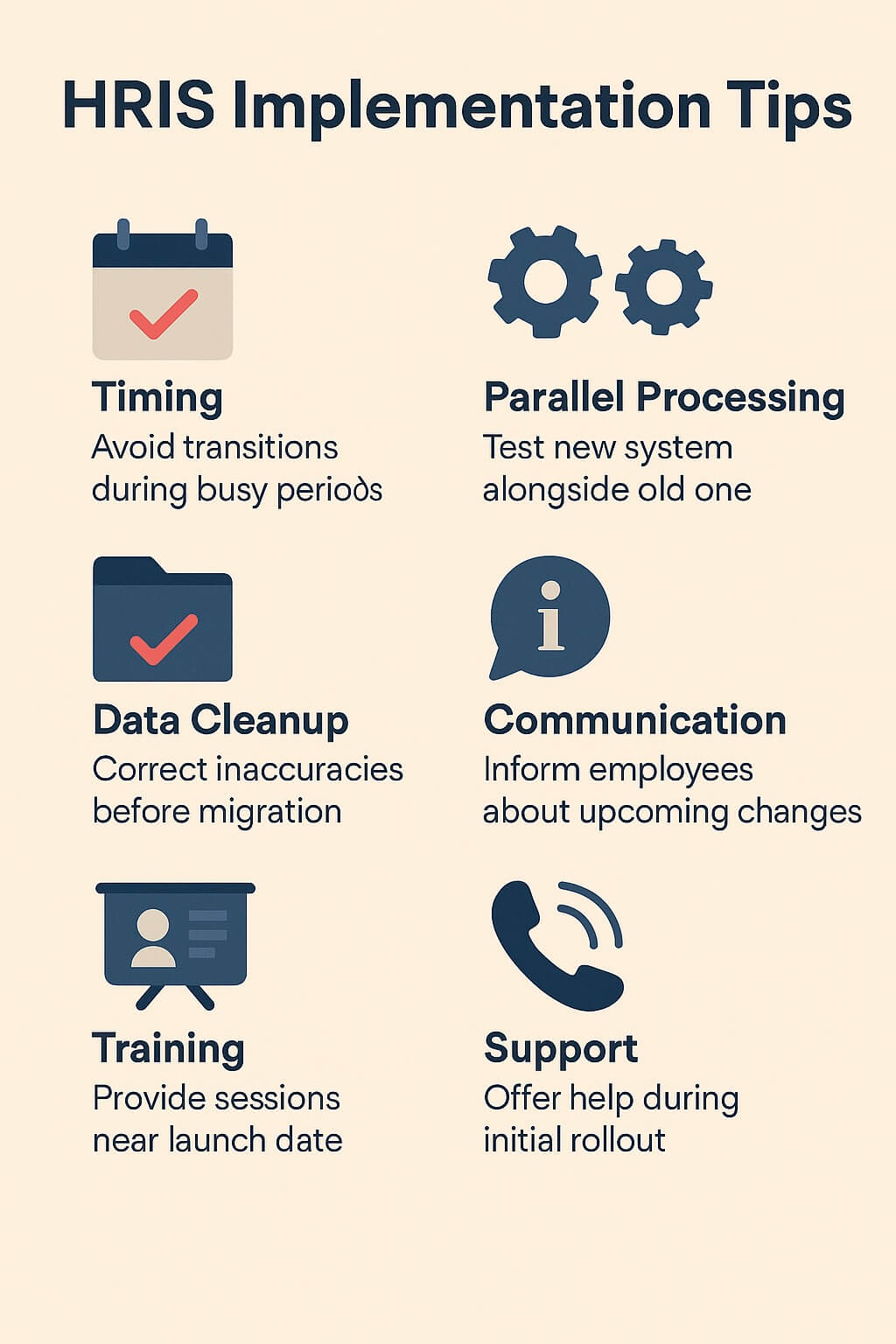

Timing matters significantly. Avoid implementing new payroll software right before year-end or during your busy season. Similarly, switching time tracking systems mid-pay period creates headaches. Plan for implementation during a relatively calm period when you can focus on getting it right.

Parallel processing, where you run both old and new systems simultaneously for a period, provides a safety net but doubles your work temporarily. For payroll especially, many organizations run at least one payroll cycle in both the old and new systems to verify accuracy before fully committing.

Data cleanup before migration saves enormous trouble later. Take time to review your current employee files, correct inconsistencies, remove outdated information, and organize documents. Migrating messy data just moves the mess to a new location.

Communication with employees about the change, what’s happening, when it’s happening, and how it affects them reduces anxiety and resistance. Explain why you’re making the change, acknowledge that there will be a learning curve, and provide clear instructions for what they need to do.

Training should happen close to go-live, not weeks in advance. People forget training if they can’t immediately apply it. Plan for quick refresher sessions right before launch and follow-up training to address questions that arise during actual use.

Support during the first few weeks is critical. Plan for extra time to help employees with questions, troubleshoot issues, and work through problems. The first couple of pay cycles with new payroll software often involve extra checking and verification.

What actually matters in customer reviews and references?

When researching HRIS options, you’ll find reviews, case studies, and references. Some information is useful, some is misleading.

Size-specific reviews matter most. A review from a Fortune 500 company tells you nothing about whether the system works well for a sixteen-person nonprofit. Look specifically for reviews from organizations similar to your size and type.

Recent reviews are more relevant than old ones. Software changes rapidly. A complaint from three years ago might have been addressed. Similarly, a positive review from five years ago might not reflect the current system quality or company direction.

Patterns in reviews matter more than individual complaints. Every system will have some negative reviews. What you’re looking for are patterns—consistent complaints about customer service, frequent mentions of specific features not working, or repeated issues with implementation.

Request references from the vendor, but with a specific ask. Don’t just say “can you provide references?” Ask for references from nonprofit organizations with similar size, similar use cases, and who implemented within the last year. Then actually call those references with specific questions.

Third-party review sites can be helpful but treat them skeptically. Some reviews are fake, some are from disgruntled employees of the vendor rather than actual customers, and companies sometimes incentivize positive reviews.

How do contract negotiations work for small nonprofits?

You might think you have no negotiating power as a small organization, but you have more leverage than you’d expect.

Everything is negotiable. The first price quote is almost never the final price. Vendors expect negotiation, and sales representatives have flexibility on pricing, contract terms, and included services. Don’t accept the initial offer without pushing back.

Nonprofit status provides leverage. Many companies genuinely want to support nonprofit missions and offer discounts. Even if they don’t advertise nonprofit pricing, ask directly. The worst they can say is no.

Longer commitments can reduce monthly costs. If you’re willing to sign a two or three-year contract instead of annual, vendors often provide significant discounts. However, balance this against the risk of being locked into a system that doesn’t work well for you.

Bundling services increases your negotiating position. If you’re committing to multiple modules or bringing payroll processing with significant revenue, you have more room to negotiate on overall pricing.

Implementation and training can often be negotiated into the contract at reduced rates or included. If the vendor quotes separate implementation fees, ask about including it or reducing the cost.

Payment terms might be flexible. If upfront annual payment strains your budget, ask about monthly or quarterly billing. Some vendors prefer annual prepayment and will discount for it, while others accommodate monthly billing without penalty.

What happens when things go wrong with your HRIS?

Even the best systems have problems, and knowing how vendors handle issues matters as much as the features they offer.

Payroll errors are the most critical failure mode. If employee paychecks are wrong or late, it affects real people’s lives and damages trust. Understand the vendor’s guarantee around payroll accuracy and what happens if they make mistakes. Who’s responsible for fixing errors and any resulting penalties?

System downtime hopefully is rare but will happen eventually. What’s the vendor’s uptime guarantee? How do they communicate outages? What’s your backup plan if the system is down during a critical period like payroll processing?

Data security breaches are a nightmare scenario. What security measures does the vendor have in place? What happens if there’s a breach? How quickly will they notify you, and what support do they provide to affected employees?

Support responsiveness determines how quickly problems get resolved. Test their support during the trial or demo period. Submit a question and see how long it takes to get a real answer, not just an automated response.

Vendor stability matters more than people often consider. Is this a well-established company or a startup that might be acquired or go out of business? While new companies can offer innovative features, they also carry more risk of significant changes or even discontinuation of service.

Can you realistically implement this yourself or do you need help?

Be honest about your technical capability and available time. HRIS implementation is a project, not just installing software.

Your technical comfort level matters. If configuring software, mapping data fields, and troubleshooting technical issues stresses you out, you’ll want a vendor with strong hands-on implementation support or you’ll need to hire a consultant.

Time availability is crucial. Even with vendor support, implementation requires significant time from your team for planning, data preparation, testing, and training. If you’re already overwhelmed with daily responsibilities, implementation will suffer or drag on indefinitely.

HR consultants who specialize in HRIS implementation can be worth the cost if you lack internal capacity. They’ve done this before, know the pitfalls, and can get you operational faster. For a small nonprofit, this might be a one-time expense that pays for itself in faster implementation and fewer mistakes.

Vendor implementation services vary dramatically in quality. Some vendors provide excellent hands-on implementation support that makes the process smooth. Others give you credentials and a link to documentation. Understanding what level of support you’ll receive is essential to determining whether you can handle implementation.

What’s different about HRIS selection now versus five years ago?

The HRIS market has changed significantly in recent years, which affects your options and decision-making.

Cloud-based systems have become standard. You’re no longer choosing between local servers and cloud solutions—everything is cloud-based now. This is generally good for small organizations because it means no servers to maintain and you can access the system from anywhere.

Mobile functionality has improved dramatically. Employees expect to handle HR tasks from their phones, and modern systems actually deliver good mobile experiences rather than just clunky mobile websites.

Artificial intelligence features are appearing in HRIS platforms, though they’re often more marketing hype than practically useful for small organizations. Some AI features like resume parsing in applicant tracking or chatbots for employee questions can be helpful. Others are solutions looking for problems.

Compliance automation has become more sophisticated. Systems now better handle multi-state employment, changing labor laws, and HR compliance requirements. This is particularly valuable for small organizations that lack dedicated compliance expertise.

Price competition has generally benefited small organizations. As more vendors enter the market targeting small businesses and nonprofits, pricing has become more competitive and transparent.

Integration ecosystems have expanded. Modern HRIS platforms typically integrate with dozens or hundreds of other business applications, making it easier to connect your systems without custom development.

The key is separating genuinely useful improvements from marketing buzzwords. Focus on functionality that solves your actual problems rather than being dazzled by features you’ll never use.

Making the right HRIS choice for your small nonprofit comes down to being realistic about your needs, honest about your budget and capabilities, and thorough in evaluating how systems will work in your specific situation. The goal isn’t finding the most impressive system—it’s finding the one that makes your HR processes genuinely easier while fitting within your constraints.