Starting a new job brings excitement and new opportunities, but it also raises important questions about benefits that could impact your future family plans. Many employees wonder if asking about parental leave and disability benefits during the hiring process might create a negative impression. The truth is that understanding your benefits is not only acceptable but also smart financial planning.

Is It Okay to Ask About Parental Leave Benefits?

Asking about parental leave and other benefits during the job evaluation process is completely normal and professionally appropriate. The best time to ask about paid parental leave is before you take the job, not after you’re already employed, according to career experts. Employers expect candidates to evaluate the complete compensation package, which includes benefits beyond just salary.

Smart job seekers understand that benefits can represent 30-40% of their total compensation value. Companies that offer competitive parental leave often view it as a selling point for attracting top talent. When you ask thoughtful questions about benefits, you demonstrate that you’re making informed career decisions and planning for the future.

The key is timing and approach. During initial interviews, focus on your qualifications and fit for the role. Once you receive a job offer or reach final interview stages, it becomes appropriate to discuss the complete benefits package in detail.

When and How to Ask About Benefits

The most appropriate time to inquire about specific benefit details is after receiving a job offer but before accepting it. This timing shows genuine interest in joining the company while ensuring you have complete information to make an informed decision.

When asking about benefits, frame your questions professionally and focus on understanding policy details rather than personal circumstances. For example, instead of saying “I’m planning to have a baby,” you might ask “Could you clarify how the parental leave policy works and what the eligibility requirements are?”

During benefits discussions, it’s helpful to prepare specific questions that show you’ve reviewed the basic information but need clarification on important details. This demonstrates thoroughness rather than lack of preparation.

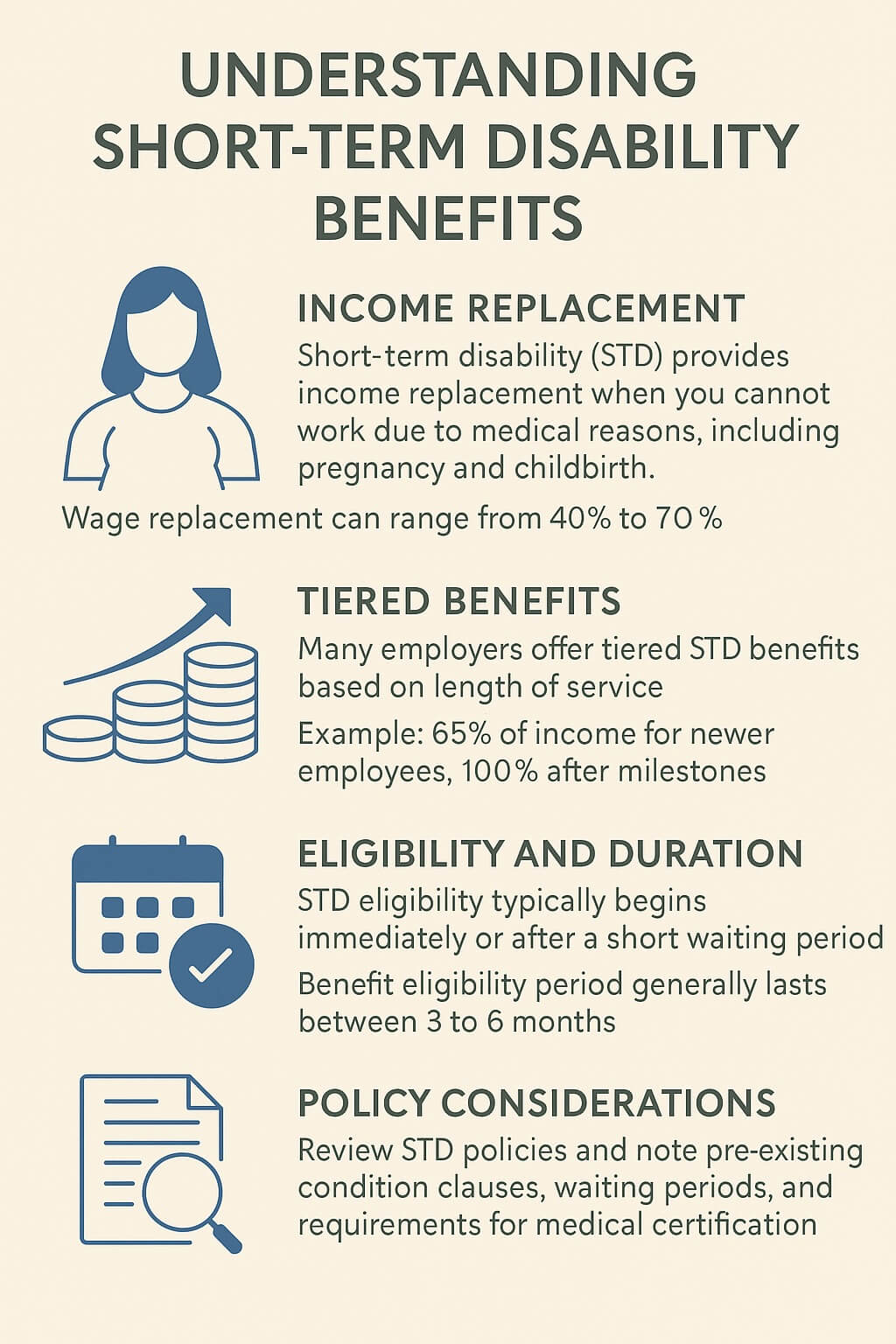

Understanding Short-Term Disability Benefits

Short-term disability (STD) insurance provides income replacement when you cannot work due to medical reasons, including pregnancy and childbirth. Wage replacements can range from 40% to 70% with a monthly benefit maximum in some cases, making it an important financial safety net for new parents.

Many employers offer tiered STD benefits based on length of service. Some companies provide 65% income replacement for newer employees and increase to 100% after reaching certain service milestones. Understanding these tiers helps you plan timing for major life events and budget for potential income reductions.

STD eligibility typically begins immediately or after a short waiting period, but benefit amounts and duration may vary based on your tenure. The benefit eligibility period generally lasts between 3 to 6 months, which can cover the typical recovery period after childbirth.

When reviewing STD policies, pay attention to pre-existing condition clauses, waiting periods, and any requirements for medical certification. Some policies may have different terms for pregnancy-related disabilities compared to other medical conditions.

Parental Leave Policies Explained

Modern parental leave policies vary significantly between employers, with some offering generous paid leave while others provide only the federally mandated unpaid leave under the Family and Medical Leave Act (FMLA). Progressive companies may offer 12-16 weeks of paid leave, while others provide shorter periods or unpaid time off.

The phrase “up to” in parental leave policies can indicate several possibilities. It might mean the maximum available regardless of service length, or it could suggest tiered benefits where longer-tenured employees receive more time off. Some companies also differentiate between birth parents and non-birth parents in their leave allocations.

Understanding whether parental leave runs concurrently with STD benefits is crucial for financial planning. In many cases, STD covers the medical recovery period while additional parental bonding leave extends beyond the disability period, potentially providing several months of protected time off.

Questions to Ask About Benefit Details

When discussing benefits with HR representatives or hiring managers, prepare specific questions that help you understand the complete picture. For STD benefits, you might ask about the specific service requirements for different benefit tiers, waiting periods, and how benefits coordinate with state disability programs.

For parental leave policies, inquire about eligibility requirements, whether leave is paid or unpaid, how it coordinates with STD benefits, and any flexibility in timing or usage. Understanding whether leave can be taken continuously or intermittently helps in planning your time off.

Ask about benefit enrollment deadlines and whether you can make changes during your first year of employment. Some benefits have limited enrollment periods, while others allow changes for qualifying life events like marriage or pregnancy.

Timing Benefits Around Service Requirements

If your research reveals significantly better benefits after completing one year of service, you might consider timing major life events accordingly. This strategic approach is common and financially prudent, though it requires balancing personal preferences with practical considerations.

Many jobs require you to be there a year before getting paid parental leave, making timing an important factor in family planning. However, remember that life doesn’t always follow planned timelines, and having some benefits is better than having none.

Consider that even if benefits improve after one year, you’ll still have basic protections under federal and state laws. FMLA provides job-protected unpaid leave after you’ve worked for 12 months, and state disability programs may provide some income replacement regardless of employer benefits.

Professional Ways to Frame Benefit Questions

When discussing benefits, use professional language that focuses on understanding policies rather than sharing personal plans. Instead of mentioning specific intentions, ask about general eligibility and policy structure. This approach respects professional boundaries while gathering the information you need.

Frame questions around hypothetical scenarios or general understanding. For example, “Could you walk me through how someone would use the parental leave benefits?” or “What are the different tiers of STD coverage based on service length?” These questions demonstrate thoroughness without revealing personal information.

Remember that you’re not obligated to share personal family planning details during the hiring process. Your questions about benefits should focus on understanding what’s available to all employees rather than your specific situation.

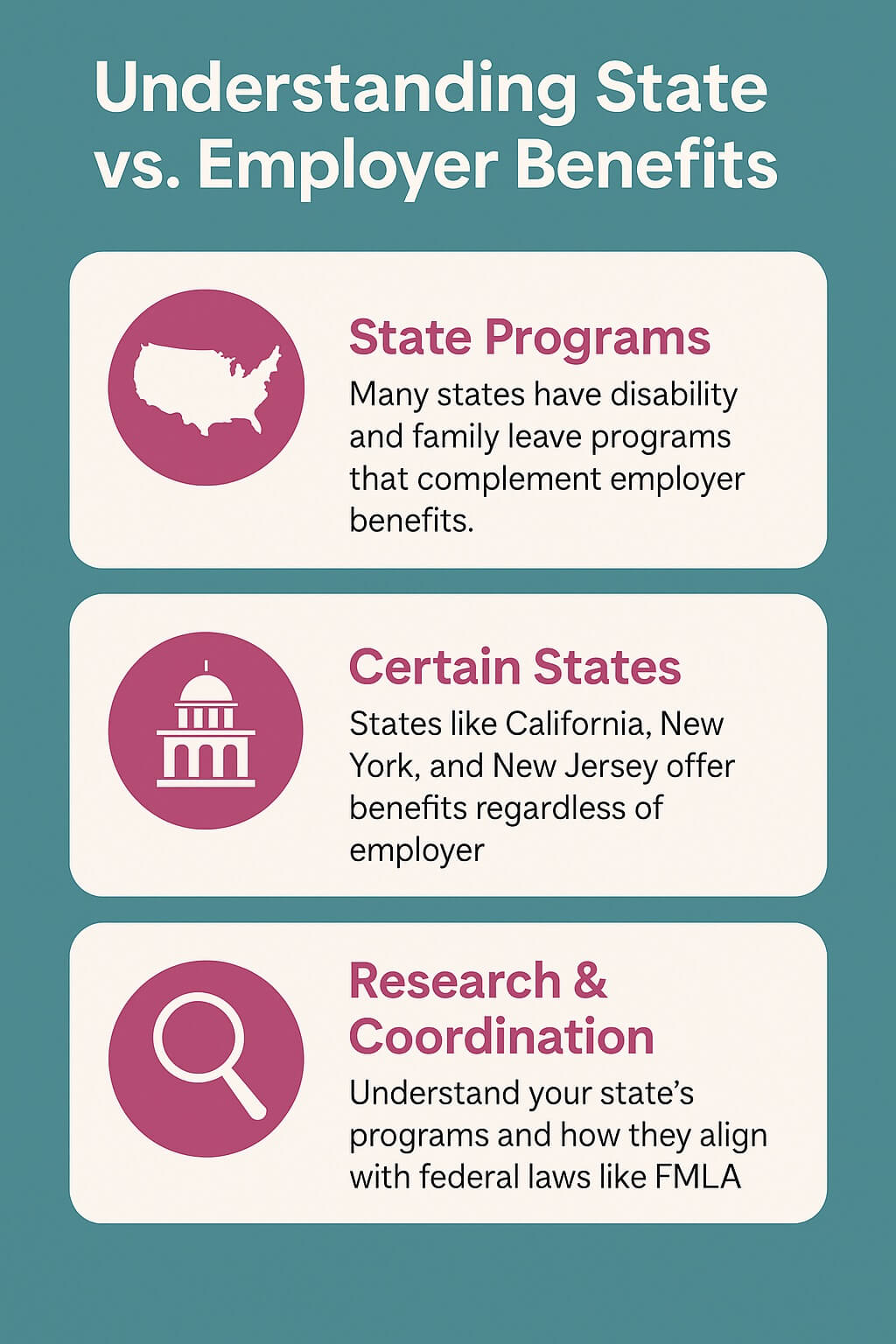

Understanding State vs. Employer Benefits

Many states provide their own disability and family leave programs that supplement or run alongside employer benefits. Understanding how these programs coordinate with your employer’s policies helps you maximize your total benefits and plan financially for time off.

Some states like California, New York, and New Jersey have robust state disability and family leave programs that provide benefits regardless of employer size or policies. In these states, you may have protection and income replacement even if your employer offers minimal benefits.

Research your state’s specific programs and how they interact with federal laws like FMLA. This knowledge helps you understand your complete benefit picture and can inform your decision-making about job offers and timing of major life events.

Red Flags vs. Normal Benefit Inquiries

Asking detailed questions about benefit policies is normal and expected. Red flags would include inappropriate personal disclosures, demanding benefit modifications before accepting a job offer, or asking about benefits during inappropriate times like first interviews.

Normal inquiries focus on understanding existing policies, eligibility requirements, and how benefits work in practice. Problematic approaches might include negotiating for special treatment, sharing unnecessary personal information, or making demands rather than asking questions.

Professional benefit discussions demonstrate good judgment and planning skills. Employers generally appreciate candidates who ask thoughtful questions about their total compensation package.

Negotiating Benefits During Job Offers

While base benefit policies are often non-negotiable, some aspects of benefits packages may have flexibility, especially for senior positions or in competitive job markets. Negotiating paid parental leave is best done before you take the job, when you have the most leverage.

Consider which benefits are most important to your situation and whether there might be creative solutions that work for both you and the employer. Some companies might offer flexible start dates, additional unpaid leave, or other accommodations even if they can’t change their standard policies.

Remember that benefit negotiations should be part of a broader compensation discussion rather than isolated requests. Consider the total value of salary, benefits, growth opportunities, and work-life balance when evaluating job offers.

Planning for Different Scenarios

Even with careful planning and research, life circumstances can change unexpectedly. Having a basic understanding of your minimum protections under federal and state laws helps you prepare for various scenarios.

Consider both optimal timing scenarios where you can maximize benefits and less ideal situations where you might need to use benefits earlier than planned. Understanding your options in both cases reduces anxiety and helps you make informed decisions as circumstances evolve.

Build relationships with HR representatives who can provide guidance as your situation changes. Having established professional relationships makes it easier to navigate benefit claims and policy questions when you need support.

Making Informed Career Decisions

Evaluating benefits alongside other job factors helps you make career decisions that support your long-term goals. Consider how current benefits compare to industry standards and whether the company’s approach to work-life balance aligns with your values.

Remember that benefits are just one component of job satisfaction and career growth. While important for financial planning, they should be weighed alongside factors like role responsibilities, company culture, advancement opportunities, and overall compensation.

Document benefit details from different job opportunities to make informed comparisons. This systematic approach helps you evaluate offers objectively and choose positions that best support your professional and personal goals.

Long-Term Career and Family Planning

Understanding your benefits helps you plan both career progression and family timing in ways that optimize your financial security and professional growth. This long-term perspective can guide decisions about job changes, skill development, and major life events.

Consider how your current employer’s policies might influence your decision to stay or seek new opportunities. Companies with generous family benefits often indicate broader commitments to employee well-being that may benefit your long-term career development.

Stay informed about changing benefit trends in your industry. As more companies recognize the importance of family-friendly policies, benefit packages continue to evolve and improve, potentially creating new opportunities for career moves that better support your personal goals.

Citations and References

- U.S. Department of Labor. (2024). How to Talk to Your Employer About Taking Time Off for Family and Medical Reasons.

- The Muse. (2019). How to Negotiate Paid Parental Leave Before Taking a Job.

- ADP. (2025). Short-Term Disability: What Qualifies & How it Works.

- Patient Advocate Foundation. (2024). Short Term Disability and Its Benefits.

- Great Place To Work. (2025). Parental Leave: How Much Time Off Do Companies Give?

- HuffPost Life. (2024). How To Ask About Parental Leave During A Job Interview.

- InHerSight. (2019). How to Ask for Maternity Leave When Your Job Doesn’t Offer It.

- U.S. Department of Labor. Employment Laws: Medical and Disability-Related Leave.