Payroll accuracy isn’t just a numbers game—it’s the cornerstone of employee trust and organizational compliance. After spending 15 years optimizing HCM integrations for companies ranging from healthcare systems to manufacturing giants, I’ve seen how a single misaligned time entry between UKG Pro and Workday can cascade into serious problems. Consider the retail manager whose holiday pay gets miscalculated due to sync failures, triggering not only payroll corrections but potential labor disputes and audit flags. These aren’t isolated incidents—they’re systemic risks that plague organizations relying on manual data transfers between their time tracking and payroll systems. The solution lies in robust integration strategies that eliminate human error while maintaining data integrity across platforms. In this comprehensive guide, I’ll share proven methodologies for seamless UKG Pro to Workday synchronization, reveal insights from my extensive fieldwork, and showcase how modern integration tools like CloudApper iPaaS transform this critical process from liability into competitive advantage.

What Is Time Data Sync Between UKG Pro and Workday Payroll?

Time data sync refers to the automated transfer of employee time entries—such as regular hours, overtime, shift differentials, and absences—from UKG Pro’s time and attendance module to Workday’s payroll engine. This ensures that earnings (like base pay, bonuses, and premiums) and deductions (such as taxes, benefits contributions, and garnishments) are calculated accurately based on real-time data.

UKG Pro excels in workforce management, capturing detailed time punches, schedules, and accruals. Workday Payroll, on the other hand, focuses on comprehensive payroll processing, including compliance with local regulations. When integrated, time data flows bi-directionally: punches from UKG update Workday for payroll runs, and payroll adjustments (like retroactive pay) feed back to UKG for record-keeping. In my experience, this sync is vital for industries like retail and healthcare, where variable shifts are common. Without it, discrepancies arise— for instance, an unaccounted sick day could skew deduction calculations for health insurance premiums.

The sync typically leverages APIs and connectors. UKG Pro’s open API endpoints allow extraction of time data in formats like JSON or XML, which Workday’s integration cloud platform can ingest. This process handles earnings by mapping time codes to pay components and deductions by applying rules for withholdings based on synced hours.

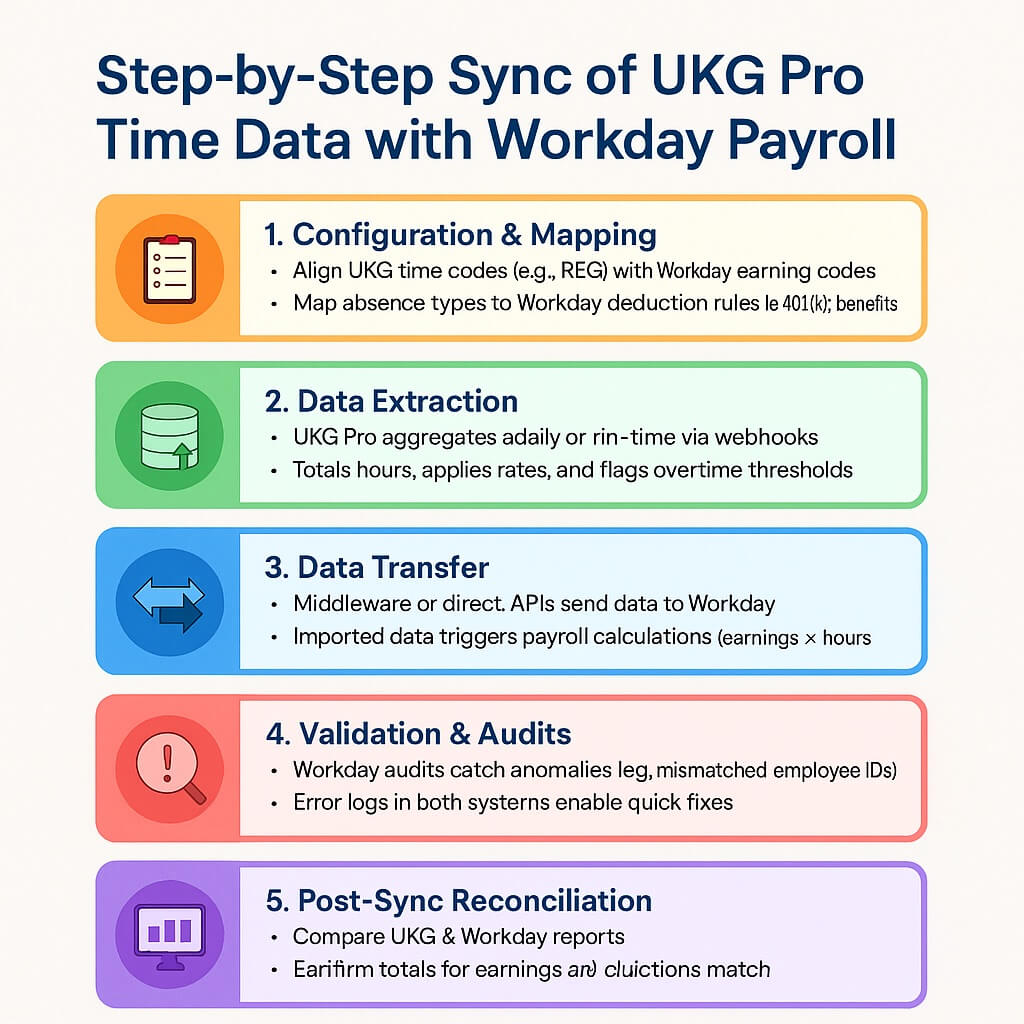

Step-by-Step Process of Syncing Time Data for Earnings and Deductions

The integration process starts with configuration. First, map data fields: UKG’s time codes (e.g., “REG” for regular hours) align with Workday’s earning codes. Deductions follow suit—UKG’s absence types link to Workday’s deduction rules, ensuring items like 401(k) contributions adjust based on worked hours.

Next comes data extraction. UKG Pro aggregates time data daily or in real-time via webhooks. For earnings, this includes totaling hours and applying rates; for deductions, it flags variables like overtime thresholds that affect tax brackets. The data then transfers through middleware or direct APIs. In Workday, imported data triggers payroll calculations: earnings are computed by multiplying hours by rates, while deductions are subtracted post-gross pay.

Validation is key. Workday runs audits to catch anomalies, like mismatched employee IDs, before finalizing payroll. If issues arise, error logs in both systems allow quick fixes. From my projects, I’ve learned to schedule syncs outside peak hours to avoid latency— a tip that prevented a major payroll delay for a client with 5,000 employees.

Finally, post-sync reconciliation ensures accuracy. Reports from both systems compare totals, confirming earnings and deductions match. This step has saved me hours in audits, as it highlights discrepancies early.

Common Challenges in UKG Pro to Workday Integration and How to Overcome Them

Integrations aren’t always smooth. Data mapping mismatches are common—UKG’s custom time codes might not directly translate to Workday’s predefined ones, leading to incorrect earnings. In one integration I led for a manufacturing firm, mismatched shift premiums caused overpayments in deductions. The fix? Custom mapping scripts and thorough testing.

Latency and real-time sync issues arise with high-volume data. Batch processing can delay updates, affecting deductions like hourly benefits. To counter this, use event-driven syncs via APIs, which I’ve implemented to reduce delays from hours to minutes.

Security and compliance pose risks. Data in transit must be encrypted, and access controlled to meet GDPR or CCPA standards. I’ve always prioritized role-based access in setups, ensuring only payroll admins view sensitive deduction details.

Scalability is another hurdle for growing organizations. As employee counts rise, sync volumes increase, straining systems. Cloud-based solutions help here, scaling automatically without hardware upgrades.

Benefits of Integrating UKG Pro Time Data with Workday Payroll

The payoffs are substantial. Accuracy improves dramatically—automated syncs eliminate manual entry errors, ensuring earnings reflect exact hours and deductions are precise. In my career, clients have reported 30-40% reductions in payroll corrections post-integration.

Efficiency soars. What once took days in manual reconciliations now happens in minutes, freeing HR teams for strategic tasks. Compliance enhances too, as synced data supports accurate tax filings and audit trails.

Employee experience benefits directly. Timely, correct paychecks boost morale; self-service portals in both systems let workers view synced time and earnings transparently. For deductions, integrations handle complex scenarios like variable insurance premiums based on hours worked.

Cost savings follow. Fewer errors mean less rework and penalties. One retail client I worked with saved thousands annually by avoiding overpayments in overtime deductions.

Broader HCM harmony emerges. Integrating time data paves the way for unified analytics, where Workday’s reporting combines with UKG’s workforce insights for better forecasting.

Best Practices for Successful Data Synchronization

From years troubleshooting integrations, here are my top tips. Start with a clear roadmap: Assess data flows, involve stakeholders from HR and IT, and define success metrics like sync success rates above 99%.

Test rigorously. Use sandbox environments to simulate high-volume syncs, catching issues before go-live. I once identified a deduction mapping flaw during testing that could have affected 20% of a workforce.

Monitor continuously. Set up dashboards in tools like Workday’s integration monitoring or UKG’s logs to track sync health. Alerts for failures have been lifesavers in my projects.

Train users. HR staff need to understand how synced data affects earnings and deductions to handle exceptions.

Choose reliable tools. Direct APIs work for simple setups, but for complexity, iPaaS platforms excel.

Leveraging CloudApper iPaaS for Effortless UKG and Workday Integration

This is where CloudApper iPaaS shines. As a no-code platform, it enables real-time, bi-directional sync between UKG Pro and Workday without custom development. Their UKG Sync package handles time data seamlessly, mapping fields for earnings and deductions with point-to-point integrations via standardized APIs. In my experience, setups that took weeks with traditional methods were done in days using CloudApper.

The platform ensures data integrity—no transformations needed, just direct transfers. For earnings, it syncs hours and rates instantly; for deductions, it applies rules dynamically. Benefits include 99.9% uptime, 24/7 support, and white-glove service where experts handle configuration.

CloudApper isn’t limited to Workday. It integrates UKG with leading HR systems like ADP, BambooHR, and Oracle HCM; payroll platforms such as Paychex and Ceridian; and ATS like Taleo and Lever. This versatility allows for comprehensive ecosystems—sync time data to ATS for recruitment analytics or to ERP for financial forecasting.

One project stands out: A healthcare provider used CloudApper to sync UKG time to Workday payroll, then extended to their EHR system for staffing insights. The result? Reduced administrative overhead by 50% and improved deduction accuracy for shift-based benefits.

Expanding Integrations: Connecting UKG with Other HR, HCM, Payroll, and ATS Systems

UKG’s flexibility makes it a hub for broader integrations. With CloudApper, sync time data to ADP Payroll for multi-vendor setups or to SAP SuccessFactors for global HCM. For ATS, integrate with iCIMS to align time records with hiring timelines, ensuring new hires’ earnings start correctly.

In payroll, connect to QuickBooks for small businesses or Gusto for startups, automating deductions like retirement contributions. HCM expansions include syncing to Microsoft Dynamics 365 for unified employee data.

These integrations foster data-driven decisions. For example, combining UKG time with BambooHR’s performance metrics reveals correlations between hours worked and productivity, optimizing earnings structures.

Security remains paramount—CloudApper uses encryption and compliance certifications, aligning with my emphasis on trustworthy integrations.

Field Insights: 15 Years of Integration Expertise

Throughout my 15-year career handling integrations across Fortune 500 enterprises and mid-market organizations, I’ve learned that real-world implementation rarely matches theoretical planning. An early project disaster—a poorly configured UKG-to-Workday payroll sync that miscalculated deductions—resulted in compliance violations and significant client penalties. This failure became my foundation for mandatory pilot testing protocols.

Context-specific customization has proven essential. Working with a transportation company, we engineered dynamic deduction calculations for fluctuating union contributions tied to overtime hours. Platforms like CloudApper proved invaluable for handling these complex variable scenarios efficiently.

My strongest recommendation: Maintain vigilant monitoring of platform updates. Both UKG and Workday frequently modify their APIs, making quarterly integration audits non-negotiable for preventing system failures.

Conclusion: Empower Your HCM with Seamless Syncs

Syncing time data from UKG Pro to Workday Payroll for earnings and deductions isn’t just technical—it’s foundational to efficient, compliant operations. With tools like CloudApper iPaaS, what was once complex becomes straightforward, extending benefits across your HCM ecosystem. From my vantage, investing in robust integrations pays dividends in accuracy, efficiency, and employee trust. If you’re facing sync challenges, explore CloudApper iPaaS — it’s transformed integrations for many, and it could for you too.