Connecting your human resources software to your payroll system sounds straightforward in theory. Sales demonstrations show data flowing magically between systems with the click of a button. But anyone who’s actually done an integration knows the reality is messier, more complicated, and sometimes downright frustrating.

The promise is clear: enter employee information once in your HRMS, and it automatically flows to payroll. Salary changes, new hires, terminations, job transfers—everything syncs seamlessly without anyone manually entering data into multiple systems. No more copying information from spreadsheets, no more data entry errors, no more employees getting paid incorrectly because someone forgot to update payroll when their raise went through.

But getting to that promised land requires navigating technical challenges, data mapping headaches, testing nightmares, and the ongoing maintenance that nobody warns you about during the sales process. Let’s talk about what actually happens when you integrate HRMS with payroll and ERP systems, based on real experiences from people who’ve been through it.

What does HRMS to payroll integration actually involve?

Integration isn’t just plugging two systems together and watching them work. It’s about making systems that were designed independently understand each other’s data and processes.

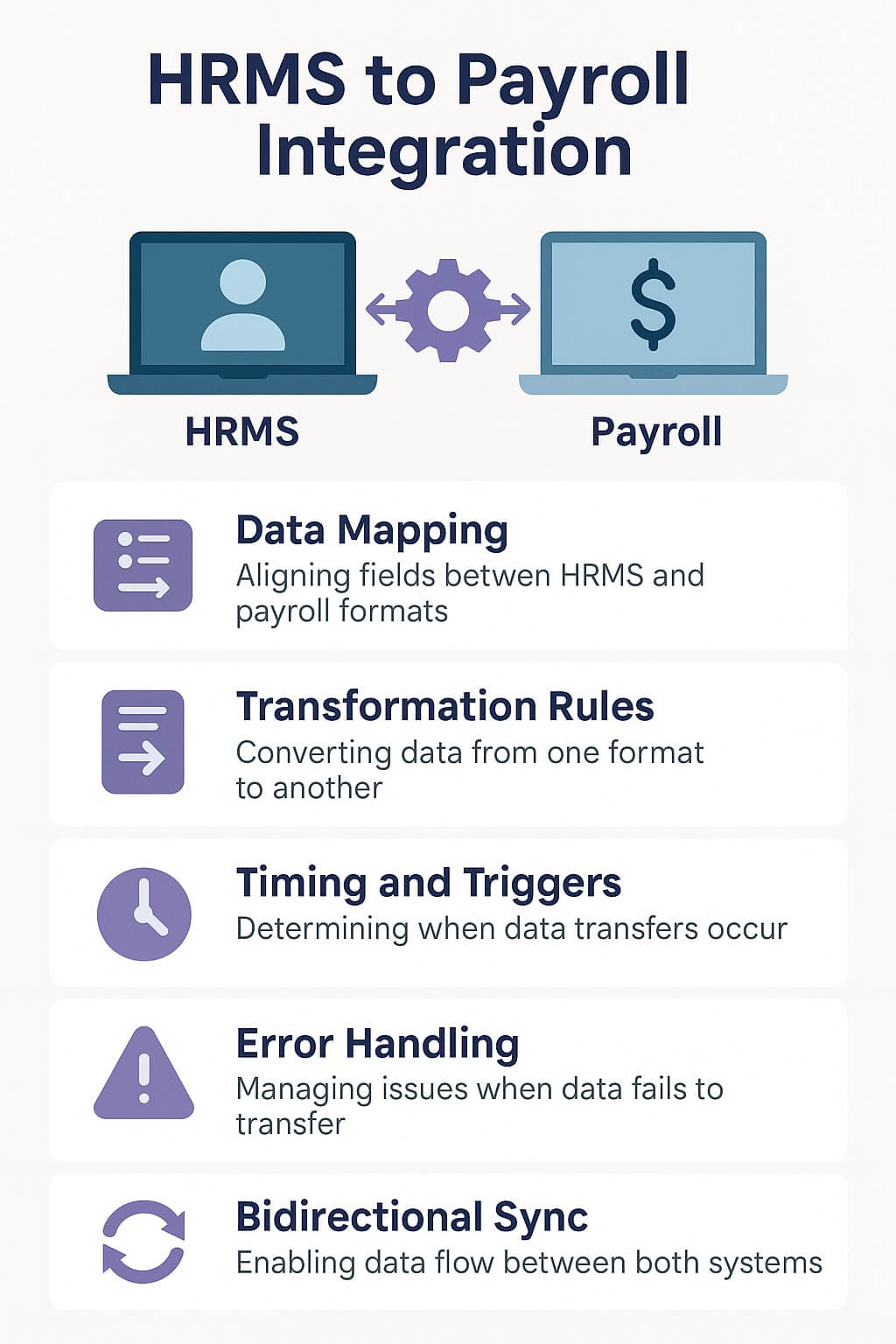

At the most basic level, integration means establishing a connection between systems so data can flow from one to the other. This might be a direct API connection where systems communicate in real-time, a scheduled batch process that transfers files at specific intervals, or middleware that sits between systems and facilitates data exchange.

Data mapping is where integration gets complicated. Your HRMS might call something “employee classification” while your payroll system calls it “worker type.” The HRMS might store addresses as separate fields for street, city, state, and zip, while payroll wants a single address field. Every single data element needs to be mapped from the source format to the destination format, and differences must be reconciled.

Transformation rules handle situations where data doesn’t translate directly. Maybe your HRMS tracks employment status as “full-time,” “part-time,” and “temporary,” but your payroll system uses codes like “FT,” “PT,” and “TP.” The integration needs transformation rules that convert one format to another.

Timing and triggers determine when data moves between systems. Does information flow immediately when changed, once daily overnight, or on-demand when someone initiates a sync? Different data types might have different timing requirements—new hires might need immediate syncing while address changes can wait for the nightly batch.

Error handling becomes critical because things will go wrong. What happens when the integration tries to create an employee record that already exists? Or when required payroll fields are empty in the HRMS? Or when someone is set up in one system but not the other? Good integrations have clear error handling, logging, and notification so problems get caught and fixed quickly.

Bidirectional sync adds another layer of complexity. Sometimes data needs to flow both directions—employee information from HRMS to payroll, but paycheck details from payroll back to HRMS for employees to view. Managing bidirectional sync without creating loops or conflicts requires careful design.

How hard is it to actually set up the integration?

The difficulty of integration setup varies enormously based on the specific systems involved and how well they’re designed to work together.

Pre-built integrations between popular systems are usually the easiest scenario. Many HRMS and payroll vendors have established partnerships with integration paths already developed and supported. These “out of the box” integrations still require configuration and data mapping, but the core technical connection is established and proven. Setup might take a few weeks with relatively straightforward implementation.

However, even pre-built integrations have limits. They typically handle standard data and common scenarios. If your organization has custom fields, unusual employment types, complex organizational structures, or unique business rules, the pre-built integration might not cover everything you need. You’ll end up with some data flowing automatically and other data still requiring manual handling.

Custom API integrations require technical expertise and significant effort. If you’re connecting systems that don’t have a pre-built integration option, you’re essentially building it from scratch. This involves developers who understand both systems, potentially on both sides, working together to create the integration. Expect months rather than weeks, and budget accordingly for development costs.

File-based integrations using CSV or XML files are sometimes an alternative when API connections aren’t feasible. The HRMS exports a file with employee data, which the payroll system imports. This is technically simpler but creates ongoing manual steps—someone needs to run exports, verify files, transfer them securely, and initiate imports. File-based integrations are also more error-prone because data validation happens only during import, after the file has already been created.

The technical complexity is only part of the challenge. Business process alignment often causes more headaches than the technology. Your HRMS and payroll systems might have different ideas about how things should work. Payroll might require information that HRMS doesn’t collect, or vice versa. These mismatches force you to either change your processes or find workarounds, neither of which is ideal.

What are the biggest headaches during integration projects?

Certain problems come up repeatedly in HRMS to payroll integration projects, catching organizations off guard even when they’ve tried to prepare.

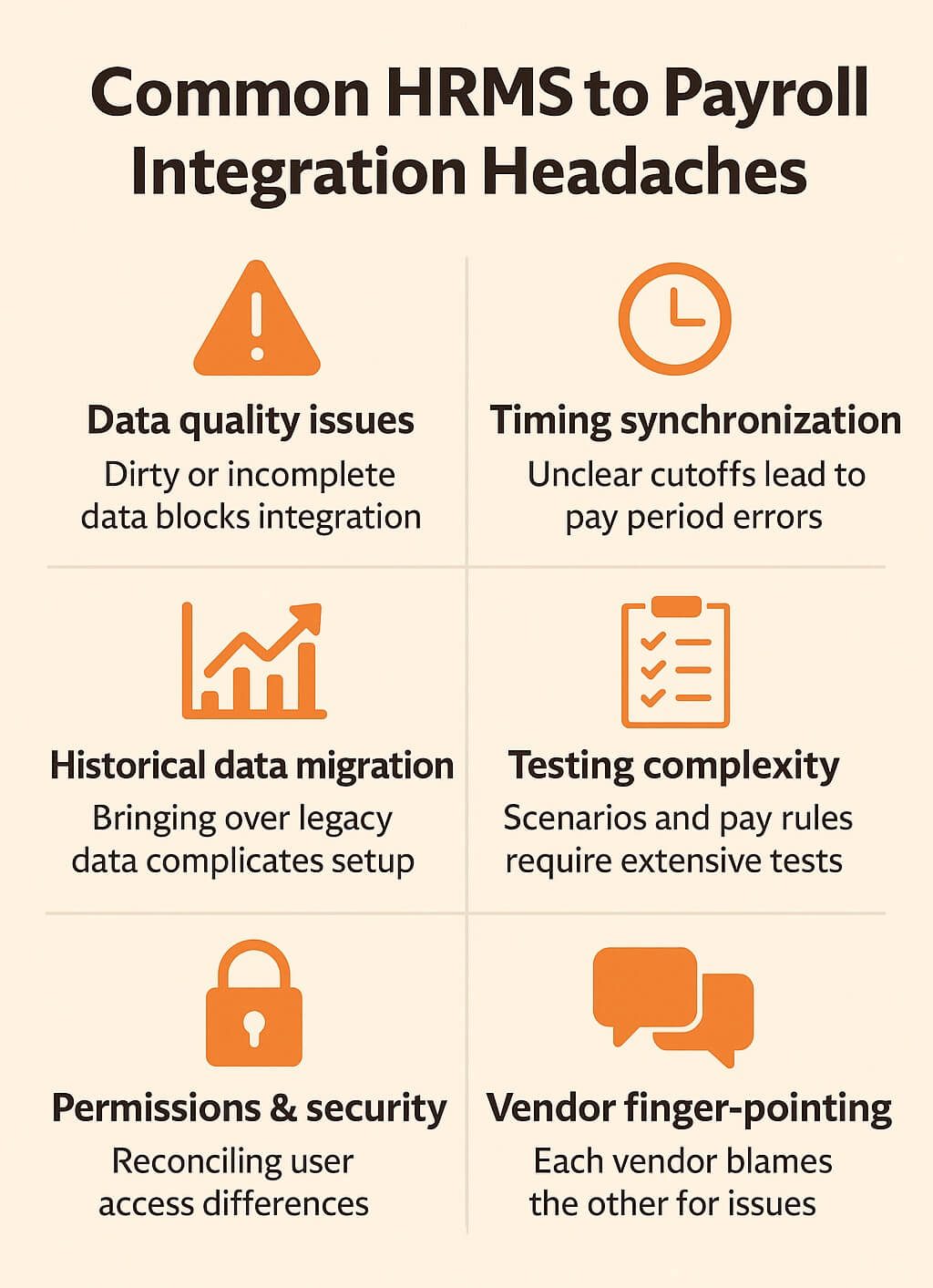

Data quality issues that were invisible suddenly become visible and blocking. When systems are separate, dirty data might not matter much—an employee with an incorrect hire date in HRMS doesn’t affect their paycheck if payroll has the correct date. But once integrated, the HRMS becomes the single source of truth. Any bad data now flows into payroll and causes problems. Most integration projects require extensive data cleanup before go-live.

Historical data migration creates unexpected complications. You need to decide how much historical data to bring over and what happens to everything before the cutover date. Payroll might need years of wage history for tax purposes, but the HRMS might not have that information readily available. Dealing with legacy data that exists in one system but not the other requires careful planning.

Testing takes far longer than anticipated. You’re not just testing that data moves successfully—you’re testing every scenario: new hires with different employment types, terminations with final paychecks, salary changes mid-pay-period, job transfers between departments, employees on leave, retroactive adjustments. Each scenario needs to be tested to ensure the integration handles it correctly. Organizations routinely underestimate how many test cycles they’ll need.

Timing synchronization causes subtle but critical problems. If payroll processing locks at a certain cutoff while HRMS changes continue to be entered, you need clear processes about what gets included in the current pay period versus pushed to the next. Employees and managers making last-minute changes after cutoff can create chaos if the timing rules aren’t clear and enforced.

Permissions and security mismatches complicate setup. The systems might have different security models, and ensuring that data flowing between them maintains appropriate confidentiality can be tricky. You don’t want sensitive payroll information flowing back to HRMS users who shouldn’t see it.

Vendor finger-pointing happens when problems arise that neither vendor wants to own. Is the issue with how HRMS is sending data or how payroll is receiving it? Each vendor blames the other, leaving you stuck in the middle trying to diagnose what’s actually wrong. This is especially frustrating when you’re paying both vendors for support.

Change management gets overlooked in favor of technical implementation. You’re changing how people work—HR staff who manually entered payroll information now enter it in HRMS instead, payroll staff who controlled employee data now receive it from HRMS. These process changes create resistance and confusion if not properly managed with training and communication.

Does integration actually save time or just create different work?

This is the critical question that determines whether integration is worth the effort and cost. The answer varies based on implementation quality and organizational factors.

When working well, integration does eliminate significant manual work. No more double data entry is the most obvious benefit. Instead of entering new employee information in both HRMS and payroll, you enter it once. Salary changes, job transfers, and terminations also happen once. For organizations with frequent changes—high turnover, lots of promotions, regular salary adjustments—this adds up to hours saved weekly.

Error reduction is a substantial but less visible benefit. Manual data entry errors cause payroll mistakes that create unhappy employees, require correction processing, and occasionally cause compliance or tax problems. When data flows automatically, these errors largely disappear. You still have errors if wrong information is entered in HRMS, but you eliminate the transcription errors that happen when transferring data between systems.

Faster processing enables quicker turnaround for changes. When a new employee gets hired, if information entered during onboarding flows directly to payroll, they can potentially receive their first paycheck faster. When an employee leaves, the termination processed in HRMS automatically stops payroll without requiring separate notification.

However, integration also creates new types of work. Monitoring and reconciliation become ongoing responsibilities. You need to regularly verify that data syncing correctly, watch for error notifications, and reconcile between systems to catch any discrepancies. This is less work than manual data entry but still requires dedicated attention.

Troubleshooting integration failures requires different skills than manual processing. When the integration breaks or gets stuck, you need someone technical enough to diagnose what’s wrong. Organizations sometimes save time on routine processing but spend it on troubleshooting technical issues.

Maintenance and updates are perpetual. Systems get updated, APIs change, and integrations need adjustments to continue working. This ongoing maintenance is invisible until something breaks, at which point it becomes urgent. Organizations that don’t budget for ongoing integration maintenance are unpleasantly surprised when they’re forced to pay for emergency fixes.

The biggest time savings come from scalability. Manual processes that were manageable with a hundred employees become overwhelming with a thousand. Integration allows you to scale without proportionally increasing administrative headcount. This benefit increases over time as your organization grows.

What breaks most often and why?

Even well-implemented integrations experience problems. Understanding common failure points helps you prepare and respond effectively.

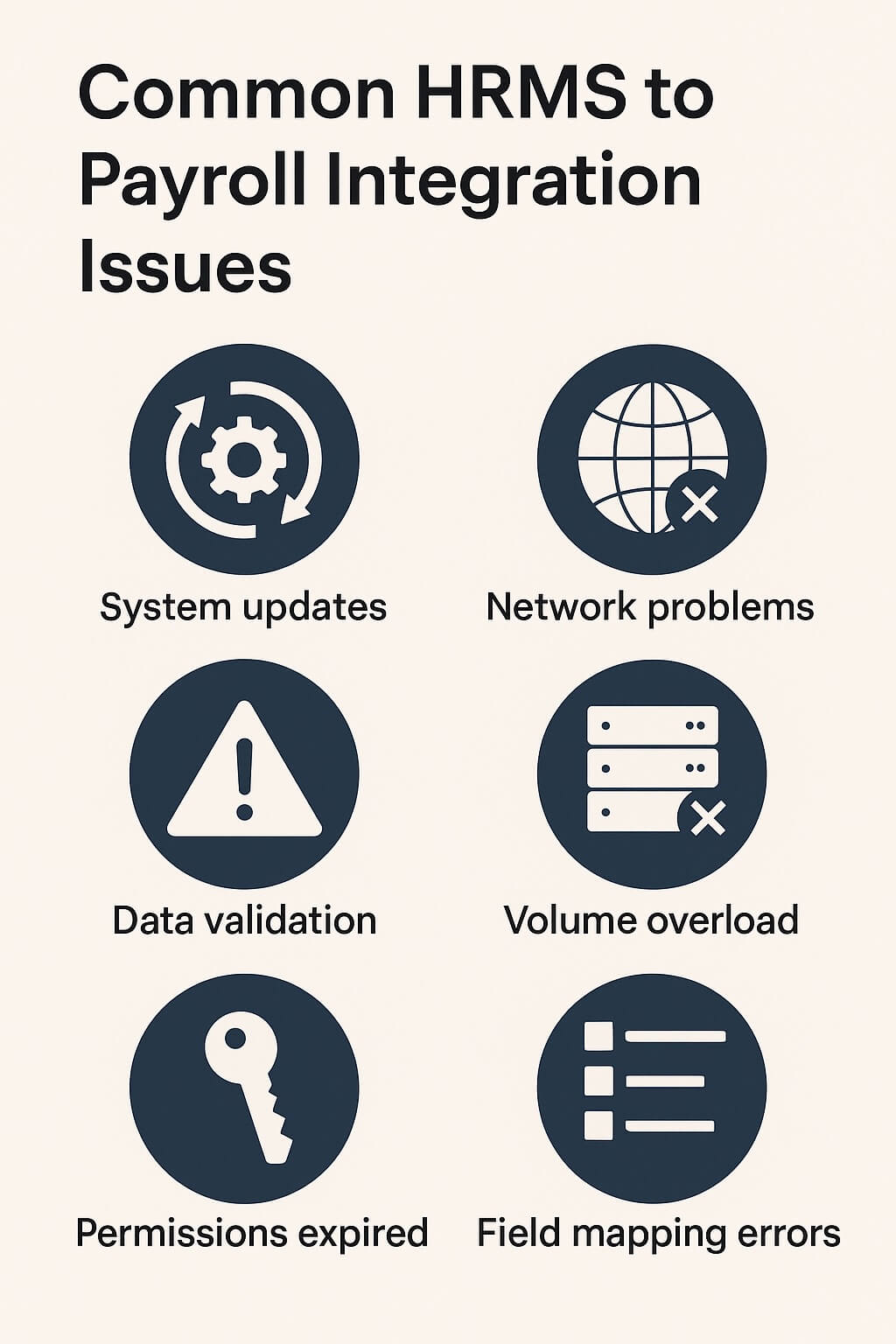

System updates and version changes are the leading cause of integration breakage. One system gets updated with changed field names, modified data formats, or altered API endpoints, and the integration stops working. Vendors sometimes make breaking changes without adequate notice or documentation, leaving you to discover problems when payroll fails to process.

Network and connectivity issues cause intermittent failures. The integration works fine most of the time but occasionally times out or loses connection mid-process. These inconsistent failures are particularly frustrating because they’re hard to reproduce and diagnose.

Data validation failures happen when information that passed HRMS validation doesn’t meet payroll requirements. Maybe someone entered a hire date in the future, or selected an employment classification that doesn’t exist in payroll. The integration attempts to transfer the data but payroll rejects it, creating error records that need manual resolution.

Volume and performance problems emerge during peak times. The integration might work fine during normal weeks but struggle during onboarding periods when dozens or hundreds of new employees get added simultaneously. The system gets overwhelmed, processes slow down or timeout, and data gets stuck.

Permission and authentication expirations cause sudden total failures. The integration might use credentials or API keys that expire periodically. When they expire without being refreshed, the entire integration stops working immediately. Organizations that don’t track these expiration dates end up with emergency situations when integrations fail unexpectedly.

Field mapping changes happen when someone modifies fields or adds required data elements in one system without updating the integration. Suddenly the integration is missing required information or trying to populate fields that no longer exist.

Duplicate record handling creates persistent problems. Someone creates an employee in both systems before the integration is active, or the integration fails and someone manually processes the change, then the integration retries. Now duplicate records exist, and determining which is correct becomes complicated.

How do you handle exceptions and special cases?

Real-world HR situations are messy and don’t always fit neatly into automated processes. Handling exceptions determines whether integration truly reduces work or just shifts it.

Manual overrides are sometimes necessary for unique situations. An employee is on unpaid leave but needs to receive a small payment for jury duty. A terminated employee is due a late-discovered final payment. The automated integration doesn’t handle these scenarios, requiring manual intervention in payroll. Organizations need clear processes for when and how to make manual adjustments without breaking the integration.

Supplemental processing often happens outside the integration. Bonuses, expense reimbursements, correction payments—these might not flow through the standard HRMS to payroll integration. You need parallel processes for handling supplemental payments, which reduces but doesn’t eliminate manual payroll work.

Audit trails and change tracking become critical when automation handles data movement. When an employee’s paycheck is wrong, you need to trace back to understand what happened. Was incorrect information entered in HRMS? Did the integration fail to transfer something? Was a manual override made in payroll? Without clear audit trails, troubleshooting becomes nearly impossible.

Reconciliation processes catch integration failures that don’t trigger obvious errors. Regularly comparing HRMS and payroll to verify they match helps identify silent failures where data simply didn’t transfer. Organizations sometimes discover that integration has been quietly failing for weeks, with changes not flowing through, only noticed when someone manually checks.

Approval workflows add complexity to integration. If salary changes require approval in HRMS before becoming effective, the integration needs to respect those workflows. Changes shouldn’t flow to payroll until approved. But this requires sophisticated integration logic that understands HRMS workflow status.

Retroactive changes challenge integration logic. An employee’s raise should have been effective two pay periods ago, but it was entered late. Does the integration automatically handle the retroactive adjustment in payroll, or does that require manual calculation? Different scenarios might need different handling, creating complexity in exception management.

What about integrating with ERP systems beyond just payroll?

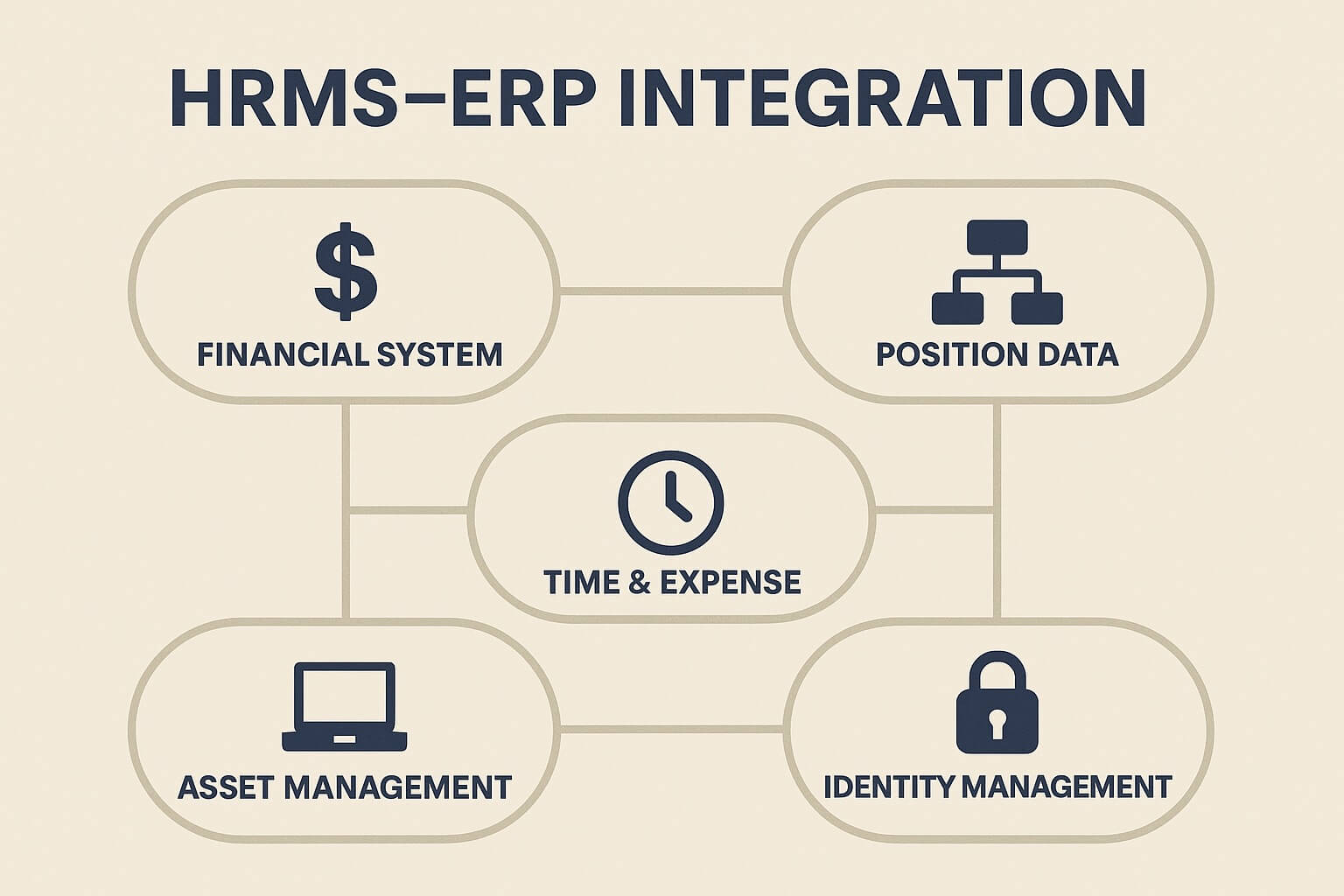

Many organizations run HRMS and payroll alongside broader enterprise resource planning systems that handle finance, procurement, and operations. Integrating across this larger ecosystem multiplies both benefits and challenges.

Financial system integration ensures that payroll expenses flow correctly to general ledger accounts. Department codes, cost centers, projects, and grants might need to be associated with employees so their compensation charges to the right budgets. Getting this integration right matters enormously for financial reporting accuracy.

Position and headcount data often needs to flow between HR and finance for budgeting purposes. Finance wants to know how many positions exist, which are filled, and what the total personnel costs are. This requires integrating not just actual employees but also open positions, salary ranges, and projected hiring.

Time and expense integration connects employee time tracking and expense reporting to project accounting. Employees log hours against projects in the time system, which flows to project costing in the ERP. They submit expense reports that need to be tied to specific cost centers or grants. This creates complex multi-system integration scenarios.

Asset management integration tracks equipment issued to employees. When someone is hired, equipment gets assigned and tracked in the asset system. When they leave, their equipment needs to be recovered. Integrating HR onboarding and offboarding with asset management automates equipment lifecycle tracking.

Access and identity management integration is critical for security. When someone is hired, they need system access provisioned. When they change roles, permissions need updating. When they leave, all access must be revoked. Integrating HRMS with identity management systems enables automated account provisioning and deprovisioning.

The challenge with ERP integration is that most ERP systems weren’t designed with HR as the primary focus. They have employee records for payroll accounting purposes but don’t have robust HRMS capabilities. Meanwhile, best-of-breed HRMS platforms have strong HR functionality but limited financial features. Getting these complementary systems to work together requires managing significant functional gaps and overlaps.

How much technical expertise does your team need?

The technical skill required for integration success depends on implementation approach, but some baseline capabilities are essential.

Someone on your team needs to understand both systems reasonably well. Not necessarily deep technical expertise, but functional knowledge of how HRMS and payroll work, what data each system contains, and how processes flow. This person becomes the bridge between technical implementation and business requirements.

Data skills are critical throughout. You need people who understand data structures, can write queries to validate data, and can analyze issues when data doesn’t match between systems. Comfortable working with spreadsheets for mapping and validation is a minimum; SQL skills for database queries are extremely helpful.

Basic API and integration concepts help even if you’re not doing the technical implementation yourself. Understanding how systems communicate, what authentication means, how errors get handled, and what logging tells you enables more effective collaboration with technical resources.

Many organizations rely on vendor implementation teams or integration consultants for the heavy technical lifting. This works but requires that you maintain enough internal expertise to manage those resources effectively, validate their work, and eventually support the integration after they’re gone.

When using pre-built integrations, the technical skill required is lower but not zero. You still need to configure the integration, map data fields, set up schedules, and manage ongoing monitoring. This is within reach for technically-inclined HR or IT staff without requiring software developers.

For custom integrations, developer expertise becomes necessary. Someone needs to write code that connects the systems, handles data transformation, manages errors, and provides logging. This might be internal IT staff, contracted developers, or consultants. The complexity and cost scale with how custom the integration needs to be.

Testing doesn’t require technical expertise but needs methodical attention to detail. Someone must create test scenarios, execute them, document results, and verify that integration behaves correctly across all situations. This is often underestimated in planning but consumes significant time.

Long-term maintenance requires ongoing technical involvement. When systems update, when business requirements change, or when problems arise, you need technical resources to modify and fix integrations. Organizations that treat integration as a one-time project and don’t plan for ongoing technical support inevitably run into trouble.

What should you do differently next time after learning the hard way?

People who’ve been through integration projects often wish they’d known certain things beforehand. These lessons come from painful experience.

Plan for significantly more time than vendors suggest. Implementation estimates are usually optimistic. Double the timeline for safer planning, especially if this is your first integration project. Rushing integration to meet unrealistic deadlines leads to inadequate testing and problems after go-live that could have been caught earlier.

Invest heavily in data cleanup before starting integration. Every hour spent cleaning data before integration saves multiple hours of troubleshooting during and after implementation. Bad data will inevitably be discovered during integration anyway, so finding and fixing it early is more efficient.

Involve payroll staff from the very beginning. They understand what payroll needs, what data is critical, what special situations occur, and what could go wrong. Leaving payroll out of integration planning and surprising them with changes later creates problems that could have been avoided.

Document everything meticulously. Field mappings, transformation rules, error handling procedures, troubleshooting steps—document it all. When problems occur six months after go-live and the implementation consultant is long gone, that documentation is invaluable. You’ll also need it when training new staff.

Test far more extensively than feels necessary. Every employment type, every pay situation, every edge case—test all of it. Run multiple parallel payroll cycles with both old and new processes to catch differences. The scenarios you don’t test are inevitably the ones that cause problems in production.

Build in redundancy and monitoring from the start. Automated monitoring that alerts when integration fails, validation reports that compare data across systems, reconciliation processes that catch silent failures—these safeguards prevent small issues from becoming large problems.

Budget for ongoing integration support, not just initial implementation. Integration isn’t a one-time expense but an ongoing operational cost. Systems will need updates, issues will arise, and requirements will change. Planning for this ongoing cost prevents getting caught without resources when problems occur.

Start with a limited scope and expand gradually. Trying to integrate everything at once is overwhelming and risky. Start with core employee data and payroll fundamentals. Once that’s stable, add benefits integration. Then time tracking. Then reporting. Phased implementation is less glamorous but more likely to succeed.

Is integration always the right choice or are there times manual is better?

Integration isn’t automatically the best solution for every situation. Sometimes keeping processes separate makes more sense.

Very small organizations might not benefit enough from integration to justify the cost and complexity. If you’re processing payroll for twenty employees twice monthly, the time savings from integration might be measured in minutes. The hours spent implementing and maintaining integration never pay back.

Organizations with extremely stable workforces see less benefit. If you hire rarely, have minimal turnover, and seldom have pay changes, there’s not much data flowing between systems. The value of automation increases with the volume of changes.

Temporary situations don’t warrant full integration. If you’re planning to replace one of the systems within a year anyway, implementing integration now just to redo it soon probably doesn’t make sense. A stopgap manual process might be more practical.

Extremely complex or unusual business rules might be easier to handle manually than to encode in automated integration. If every payroll scenario requires judgment calls and exceptions, automation struggles. Sometimes skilled humans processing things manually is more reliable than fragile automated processes that constantly break on edge cases.

Regulatory environments with strict audit requirements sometimes favor manual processes where humans verify every step. Automated integration can meet these requirements but requires extensive audit trails, validation, and controls that add significant complexity.

However, most medium to large organizations genuinely benefit from HRMS to payroll integration. The labor savings, error reduction, and process improvements outweigh the implementation challenges and ongoing maintenance. The question isn’t usually whether to integrate but rather how much to invest in making integration robust and reliable.

The reality of HRMS to payroll integration is that it’s harder than it looks, takes longer than expected, and requires ongoing attention. But when done well, it transforms HR and payroll operations from manually intensive, error-prone processes into streamlined, reliable workflows that scale efficiently as your organization grows. The key is going in with realistic expectations, proper resources, and commitment to both initial implementation and long-term maintenance.